The evidence of income inequality just keeps mounting. According to “Working for the Few,” a recent briefing paper from Oxfam, “In the US, the wealthiest one percent captured 95 percent of post-financial crisis growth since 2009, while the bottom 90 percent became poorer.”

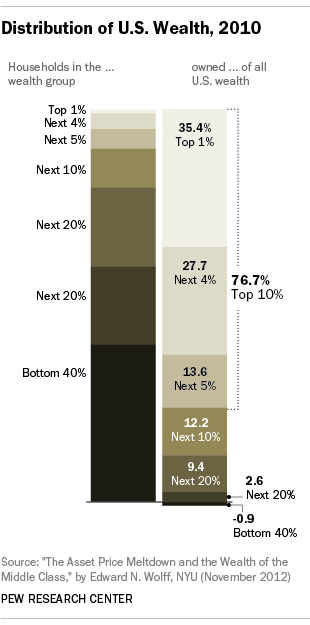

Our now infamous one percent own more than 35 percent of the nation’s wealth. Meanwhile, the bottom 40 percent of the country is in debt. Just this past Tuesday, the 15th of April — Tax Day — the AFL-CIO reported that last year the chief executive officers of 350 top American corporations were paid 331 times more money than the average US worker. Those executives made an average of $11.7 million dollars compared to the average worker who earned $35,239 dollars.

Our now infamous one percent own more than 35 percent of the nation’s wealth. Meanwhile, the bottom 40 percent of the country is in debt. Just this past Tuesday, the 15th of April — Tax Day — the AFL-CIO reported that last year the chief executive officers of 350 top American corporations were paid 331 times more money than the average US worker. Those executives made an average of $11.7 million dollars compared to the average worker who earned $35,239 dollars.

As that analysis circulated on Tax Day, the economic analyst Robert Reich reminded us that in addition to getting the largest percent of total national income in nearly a century, many in the one percent are paying a lower federal tax rate than a lot of people in the middle class. You may remember that an obliging Congress, of both parties, allows high rollers of finance the privilege of “carried interest,” a tax rate below that of their secretaries and clerks.

And at state and local levels, while the poorest fifth of Americans pay an average tax rate of over 11 percent, the richest one percent of the country pay — are you ready for this? — half that rate. Now, neither Nature nor Nature’s God drew up our tax codes; that’s the work of legislators — politicians — and it’s one way they have, as Chief Justice John Roberts might put it, of expressing gratitude to their donors: “Oh, Mr. Adelson, we so appreciate your generosity that we cut your estate taxes so you can give $8 billion as a tax-free payment to your heirs, even though down the road the public will have to put up $2.8 billion to compensate for the loss in tax revenue.”

All of which makes truly repugnant the argument, heard so often from courtiers of the rich, that inequality doesn’t matter. Of course it matters. Inequality is what has turned Washington into a protection racket for the one percent. It buys all those goodies from government: Tax breaks. Tax havens (which allow corporations and the rich to park their money in a no-tax zone). Loopholes. Favors like carried interest. And so on. As Paul Krugman writes in his New York Review of Books essay on Thomas Piketty’s Capital in the Twenty-First Century, “We now know both that the United States has a much more unequal distribution of income than other advanced countries and that much of this difference in outcomes can be attributed directly to government action.”

Recently, researchers at Connecticut’s Trinity College ploughed through the data and concluded that the US Senate is responsive to the policy preferences of the rich, ignoring the poor. And now there’s that big study coming out in the fall from scholars at Princeton and Northwestern universities, based on data collected between 1981 and 2002. Their conclusion: “America’s claims to being a democratic society are seriously threatened… The preferences of the average American appear to have only a minuscule, near-zero, statistically non-significant impact upon public policy.” Instead, policy tends “to tilt towards the wishes of corporations and business and professional associations.”

Last month, Matea Gold of The Washington Post reported on a pair of political science graduate students who released a study confirming that money does equal access in Washington. Joshua Kalla and David Broockman drafted two form letters asking 191 members of Congress for a meeting to discuss a certain piece of legislation. One email said “active political donors” would be present; the second email said only that a group of “local constituents” would be at the meeting.

One guess as to which emails got the most response. Yes, more than five times as many legislators or their chiefs of staff offered to set up meetings with active donors than with local constituents. Why is it not corruption when the selling of access to our public officials upends the very core of representative government? When money talks and you have none, how can you believe in democracy?

Sad, that it’s come to this. The drift toward oligarchy that Thomas Piketty describes in his formidable new book on capital has become a mad dash. It will overrun us, unless we stop it.