Earlier this week, a Senate panel investigated how Apple avoided billions in taxes through a web of offshore subsidiaries “so complex it spanned continents and went beyond anything most experts had ever seen.” Although the company may have achieved, in the words of Sen. Carl Levin, the “holy grail of tax avoidance,” senators didn’t accuse Apple of doing anything illegal and it is by no means alone in its use of loopholes and gimmicks to avoid paying taxes.

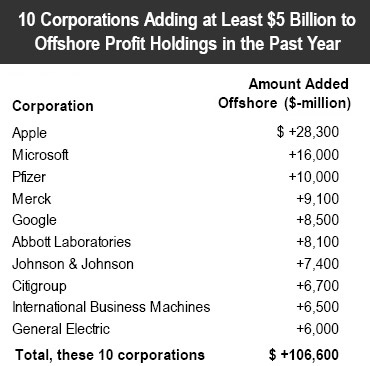

Here’s a list, topped by Apple, of 10 companies that increased their offshore holdings in the past year.

Read more about this chart on the Citizens for Tax Justice site.

The U.S. corporate tax rate is 35 percent — one of the highest in the world — but as The New York Times reported yesterday, the effective corporate tax rate (what companies actually pay) “fell to 17.8 percent in 2012 from 42.5 percent in 1960,” according to the Federal Reserve Bank of St. Louis. Another chart from the Citizens for Tax Justice shows 10 companies that managed to do much better than average, paying little or no taxes for the past five years. Dollar amounts are numbers in millions and “rate” is the effective tax rate that the companies paid.

Read more about this chart on the Citizens for Tax Justice site.