Escorted by his mother Deborah, first grader Charlie Verucchi arrives for his first day of school at Lewisburg Primary School in Olive Branch, Mississippi. (AP Photo/The Commercial Appeal, Stan Carroll)

This post first appeared at Think Progress.

A middle-class family who had a child in 2013 can expect to spend $304,408, adjusted for projected inflation, over the course of raising her until age 18, according to the latest data from the Department of Agriculture.

That price tag includes costs related to housing, utilities, furnishings, food, transportation, clothing, diapers, health care expenses, child care and education, personal care items and entertainment. Notably, it doesn’t include any birth-related costs, indirect costs like lost time, earnings, or career opportunities parents give up while raising their kids, or college costs. Parents can expect to shell out more than $10,000 a year for their children to attend an in-state public two-year school, over $30,000 for an out-of-state public university, or nearly $40,000 for a private university.

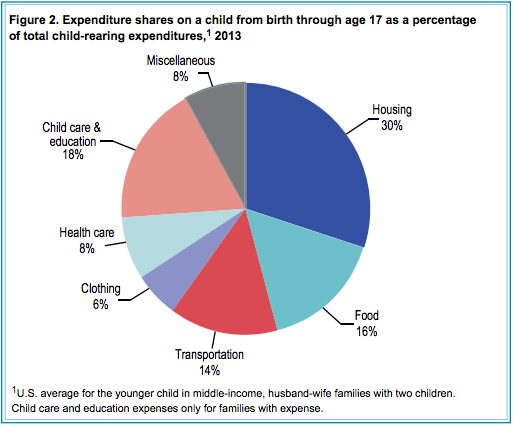

No matter a family’s income, the biggest expense is housing, eating up about a third of the total cost. For middle-income and high-income families, the cost of child care and education came in second, accounting for 18 and 23 percent respectively. For the lowest-income families, that category ate up 14 percent of the budget and came in third, but the report notes they may rely on friends or relatives because they can’t afford care in a center or school. Food came in second for low-income families, accounting for 18 percent and third for the other two groups, making up 16 percent.

Credit: USDA

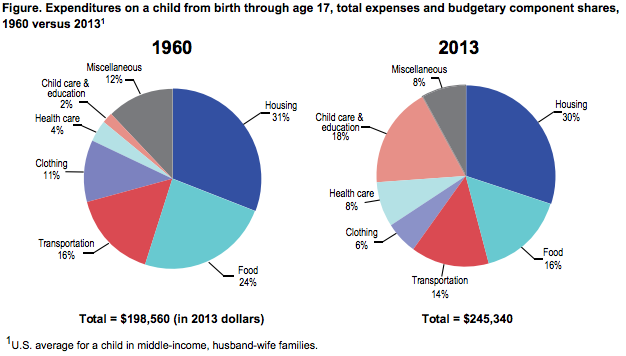

The high ticket price of raising a child in the US has gotten even higher over the years. In 1960, the average middle-class family spent just $198,560 in today’s dollars. The cost has soared 24 percent to $245,340 before being adjusted for expected inflation.

Some of the specific costs have also shifted since then. The share devoted to child care and education grew from 2 percent of total expenses in 1960 to 18 percent by 2013, mostly thanks to child care. “In 1960, child care costs were negligible, mainly consisting of in-the-home babysitting,” the report notes. But with so many more women in the workforce, more families need to pay for it. Today it costs as much as $16,430 a year to put an infant in full-time center care, and it costs more than public college in most states.

Credit: USDA

The share of money spent on health care expenses has also doubled since then.

While higher-income households spend more total dollars on raising their children, the report notes that the lowest-income ones spend the highest amount of their budget raising children, devoting 25 percent compared to 16 percent for middle-income families and 12 percent for high-income ones. The amount spent on the necessities is the same across income groups; the variation comes in how much each spends on discretionary things like entertainment.

There is little assistance for families struggling to cover these costs. Spending on child care assistance is at the lowest level since 2002 and the number of children being served by subsidies is at the lowest level since 1998. Only one in four eligible families gets any kind of rental assistance, and fewer are now getting housing vouchers than previously thanks to automatic budget cuts. Food stamps reach 79 percent of eligible families but the benefits have been repeatedly reduced.