BILL MOYERS:

And now for another reality check -- a far cry from the humbug and rhetorical static afflicting our election campaigns. Let’s talk about something President Obama and Governor Romney barely mentioned in their debates: banking reform. It’s four years since the economic meltdown knocked America and the world to our knees, four years since that massive taxpayer bailout. But if you listened to the candidates, the enormity and severity of this continuing crisis hardly merit notice. Barack Obama pledges change but touts Dodd-Frank, a bulky, watered-down version of financial reform that scarcely makes a ripple in the vast sea of corruption and abuse. Mitt Romney campaigns as the banker’s pal and says he’ll make Dodd-Frank disappear altogether.

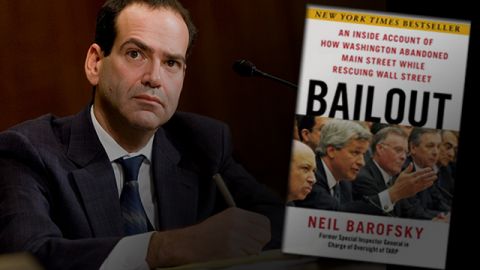

If you’re appalled by this, so is the man who held the thankless job of special inspector general in charge of policing TARP, the bailout’s Troubled Asset Relief Plan. Before he signed on, Neil Barofsky was a federal prosecutor in New York chasing white-collar criminals and drug lords; he busted 50 members of a Columbian guerrilla group deeply involved in narcotics trafficking. At TARP, he was assigned to ferret out waste, fraud and abuse. The banks didn’t make it easy, and neither did the U.S. government. Neil Barofsky tells this story in his book, “Bailout: An Inside Account of How Washington Abandoned Main Street While Rescuing Wall Street.” He is now a senior fellow and adjunct professor at the New York University School of Law.

Neil Barofsky, welcome.

NEIL BAROFSKY:

Thank you.

BILL MOYERS:

When you were a kid, did you say, "Mom, Dad, I want to grow up and be an inspector general?"

NEIL BAROFSKY:

No, I said I wanted to be a lawyer, though.

BILL MOYERS:

You did?

NEIL BAROFSKY:

It must be some sort of major genetic flaw I have. But my mom keeps a fortune cookie that said, "You will be a great lawyer one day." And I signed it and dated it. I think I was 12 years old. So there was something weird about me that I wanted to be a lawyer. I wanted to be a prosecutor. I mean, that was sort of what I wanted to do. Maybe it's from watching TV shows, Perry Mason, as a kid or something like that.

But I was always drawn to the law. And so I think I did have this drive for public service. But certainly never did think that I'd be an inspector general one day. I didn't really even know what that was until I actually got the job, to be honest with you.

BILL MOYERS:

When you took the job, I read about you. And I thought, "Why is someone like that, with that record of prosecution going to take on this job at this-- in the depth of this crisis?"

NEIL BAROFSKY:

Part of it was because this new office, this office of the Special Inspector General for TARP, with the worst acronym in Washington.

BILL MOYERS:

It really is.

NEIL BAROFSKY:

SIGTARP. Was to have two focuses. One was the oversight function and doing reports and audits and keeping an eye on Treasury and making recommendations. But what I was more focused on in the beginning and what I thought my job would be is we also created a brand-new law enforcement agency, completely from scratch, whose job was to police the TARP program.

And with $700 billion going out the door, the idea was that, inevitably, there were going to be criminal flies drawn to that honey. And our job was to catch them, do the investigations, and then get the Department of Justice to prosecute them. So I really looked at this job going in as a law enforcement job. And I was thrilled with the opportunity to build one from scratch.

But once I got down there --

BILL MOYERS:

Early 2008, wasn't it? 2008?

NEIL BAROFSKY:

I arrived in December 15th, 2008. And the money started going out the door in late October of 2008. And what I saw was that there were tremendous opportunities for abuse. There were no conditions, no strings attached and conflicts of interest being baked into some of the programs.

So I, doing what my job was as a former fraud prosecutor started pointing these out and making suggestions, recommendations to try to close these loopholes and make it less vulnerable to losses. And the response I got was remarkably eye-opening to me. I was told that maybe my concerns were valid. But I didn't need to worry about it, because these were banks.

And these banks would never, I remember this quote, "risk their reputation by putting their own profits over the public purpose behind these programs." And to be very clear, this was told to me by Paulson people under the Bush administration and the same exact words were told to me by the Geithner people under the Obama administration.

But it was a remarkable thing to hear. Because who could really believe that other than people who had come from these institutions.

And my response, of course, is "Where have you been for the last couple of years? What rock have you been under, that you haven't seen that these guys would sell their soul for a few basis points of profit?"

That ideas like they wouldn't risk their reputations or wouldn't embarrass themselves again, as Bill Dudley, the president of the New York Fed said to me when I complained about relying too heavily on credit-rating agencies. This was the core ideology and approach of how they viewed the financial crisis. It wasn't the bank's fault. And if we could just trust them, we'll be in a good place again.

BILL MOYERS:

And yet, there haven't been prosecutions have there, of these-- the people culpable for this crash?

NEIL BAROFSKY:

No, I mean, what our office did was to detect, prosecute, investigate, and refer for prosecution those who tried to steal from the program. So we were blocked out of any activities that occurred before TARP. Because we were-- our jurisdiction was limited to TARP. And we had great success. I think close to a hundred people, so far, have been charged for trying to rip off this program. We saved more than a half a billion dollars of TARP money in just one investigation alone. And the CEO who committed a multibillion dollar accounting fraud is now sitting in jail for 30 years.

But we never had the opportunity, really, to dig into the financial crisis cases that led to the cause of the crisis. But there you are absolutely correct. No senior executive has been held accountable under the criminal laws.

BILL MOYERS:

Why?

NEIL BAROFSKY:

There's no easy answer. And it depends on who you ask. So if you were to talk to someone from the Department of Justice or Wall Street they would tell you these are very complex issues. The president has mentioned that a lot of times it might be caused by greed or stupidity or avarice but not necessarily by criminal conduct.

If you were to talk to people on the other side, they would say we just have a hopelessly corrupt criminal justice system. I think the truth is a little bit more nuanced and a little bit in between. What I saw personally was a real timidity on behalf of the Department of Justice. And a lack of sophistication and expertise, when looking at the complex accounting fraud cases that I was doing.

And I think it's safe to presume that that also applied over there to the crisis-related cases. But you also have to look into the reality behind what those cases would mean. We just spent trillions of dollars of treasure, taxpayer money, an unbelievable amount of effort to save these financial institutions, save them from failure, because we believed that the failure of any one of those would bring down the entire economic system with it.

They were too big to fail in 2008. They were too big to jail in 2009.

BILL MOYERS:

I thought, at the time, this was an incestuous orgy going on there, between inside players at Washington and inside players at Wall Street. Is that too strong?

NEIL BAROFSKY:

It's probably not too strong. It's the fact that their ideology matches up. And look, one of the reasons why their ideology matches up is they all come from the same small handful of institutions. And the people I was dealing with on a daily basis came from the same financial institutions that helped cause the financial crisis and were the most generous recipients of bailouts, Goldman Sachs, Bear Sterns, which, of course, had been adopted by J.P. Morgan Chase. Goldman Sachs, Goldman Sachs, it seemed like every time I turned around, I bumped into someone from Goldman Sachs.

Which is not to single them out. But they all bring that ideology with them, when they come to Washington. It's not like somebody hits them in the head with a magic wand and they give back everything that they've learned and believed in their years of Wall Street. And they bring that ideology with them. And even those who don't come from a specific bank, when you surround yourself, create an echo chamber of likeminded people, it's not terribly surprising that the government policy looks a lot like what the Wall Street institutions themselves would have most desired.

And I think the other side effect of that is that people who are outside of that bubble, people who don't have that background, people like myself as a federal prosecutor or Elizabeth Warren, who was the chair of the Congressional Oversight Panel and before that a Harvard professor, that our views, our criticisms, our contrary positions were discounted, mocked, ridiculed, insulted, cursed at, at times. Because there was no-- we didn't have the pedigree in their world to have a meaningful contribution. So what happens is that there's no new ideas that creep in. And you get this very uniform, very non-diverse approach to the problems of finance.

BILL MOYERS:

It was puzzling to outsiders like me that you had TARP money being used to concentrate further the size of these banks.

NEIL BAROFSKY:

And the granddaddy of all those transactions, Bank of America acquiring Merrill Lynch. And the important thing to remember here is this is not banks gone wild, banks taking the money and saying, "Party time, we're going to consolidate." They did this with the encouragement of the government. And in Bank of America, a little bit with a gun to the head to complete that transaction.

This was the government policy created by the architects, Ben Bernanke who is chair of Federal Reserve, Tim Geithner, who was then the president of the New York Fed before becoming Treasury Secretary, and Hank Paulson. Their solution originally was to further concentrate the industry, to make the too big to fail banks bigger.

The theory was you take a healthier bank and mix it up with a failing bank and you get something somewhere in between, which is better overall for the system. Which may have had some validity in the very, very short term, but has put us on a path, I believe, to being even more dangerous. Because you have institutions now that are just monstrous in size, over $2 trillion in assets by certain measures, close to $4 trillion by other measures. Terrifying. The idea that any of these institutions could ever be allowed to fail is pure fantasy, at this point.

BILL MOYERS:

Are you suggesting that we could have another crash?

NEIL BAROFSKY:

I think it's inevitable. I mean, I don't think how you can look at all the incentives that were in place going up to 2008 and see that in many ways they've only gotten worse and come to any other conclusion.

BILL MOYERS:

What do you mean incentives in place?

NEIL BAROFSKY:

So in a normal functioning capitalist utopia, where, you know, most markets are that don't have this too big to fail, this presumption of government bailout if a firm like a Citigroup amasses massive amounts of risk. And in so doing, they keep razor-thin capital to absorb potential losses, which basically means they're just borrowing tons and tons of money.

And not have a lot of their own money at stake, but it's mostly borrowed money. And it is very opaque. It's not very transparent about how they're running their business. You would expect that creditors, people lending them money, counterparties, those on the other sides of their transactions would either stay away or really exact a premium. But the presumption of bailout changes that on its head and actually makes it go in the other direction. So it removes the incentive of the other market participants to impose what's known as market discipline. Because that's ideally in a capitalist society what happens is that the lenders and creditors and counterparties say, "Hey, we're not going to do business with you unless you clean house, slim down, be more transparent."

But when there's a presumption of bailout, that disappears. Because all those other market players can feel safe in the presumption that if anything goes bad at Citigroup, Uncle Sam is going to come in and make their bets whole.

Then you have the very real incentive for the executives at that institution to then pile on risk. Because they know that if the bets go well in the short term, they get paid. And they get paid very richly. But if it blows up and the risks go bad, no worry, the taxpayer's going to be on the other side of that bill.

That's what happened to Fannie Mae and Freddie Mac, before they collapsed. That's what happened to our biggest banks and global banks before they collapsed. And if you maintain that system, it is foolhardy to think that those incentives and pressures are not once again going to carry the day.

BILL MOYERS:

At a conference a week or so ago, here in New York, you said playing ball for Wall Street has become a normal way of life, despite the panic of 2008. What does it mean, "playing ball for Wall Street"?

NEIL BAROFSKY:

Well, what I saw when I was in Washington was this real pressure on myself, on other regulators to essentially keep their tone down. And I was told point blank by Assistant Secretary of the Treasury that, this is about in 2010.

And he said to me, he said, "Neil, you're a smart guy. You're a young guy. You're a talented guy. You got your whole future in front of you. You've got a young family that's starting out. But you're doing yourself real harm.” And the reason why you're doing yourself real harm is the harsh tone that I had towards the government as well as to Wall Street, based on what I was seeing down in Washington. And he told me that if I wanted to get a job out on the Street afterwards, it was going to really be hard for me.

BILL MOYERS:

You mean on Wall Street?

NEIL BAROFSKY:

Yes. And I explained to him that I wasn't really interested in that. And he said, "Well, maybe a judgeship. Maybe an appointment from the Obama administration for a federal judgeship." And I said, "Well, again, that would be great. But I don't really think that's going to happen with my criticisms." And he said it didn't have to be that way. "If all you do is soften your tone, be a little bit more upbeat, all this stuff can happen for you."

And that's what I meant by playing ball. I was essentially told, play ball, soften your tone, and all of these good things can happen to you. But if you stay harsh that was going to cause me real harm in those words.

BILL MOYERS:

What made you able to say no to the temptation?

NEIL BAROFSKY:

Well, I think part of it is the only job I ever wanted was to be a federal prosecutor.

BILL MOYERS:

Send bad guys to jail?

NEIL BAROFSKY:

It doesn't get much better than that. Really interesting, complicated work, and wear the white hat. So I didn't have those incentives that I think that were presented. And I think, look, you know, being trained in the U.S. Attorney’s Office for the Southern District of New York, I was trained to be a government employee and to take my oath of office very seriously.

But I wasn't really interested in their reindeer games. And I felt a real obligation and sense of duty to fulfill the oath that I took in Secretary Paulson's office on December 15th, 2008 to do the job that I was sent down there to do. But I wasn't really tempted with a big job on Wall Street. And frankly, if it meant getting a judgeship, compromising the job that I needed to do and was supposed to do, it just wasn't interesting to me.

But look, let me be very clear. I also have the fallback of I was a trial lawyer. I prosecuted a lot of big cases. And I knew that whatever happened, I could always go back and get a good job in New York, working at a law firm or doing legal work. So it gave me a degree of financial freedom even though I basically spent most of my career as a government employee and I didn’t have money. I didn't necessarily need to please anyone to be able to go back and still be able to feed my family.

BILL MOYERS:

What happens to a political society, to a democracy, when we stifle or bribe or shoot the sheriff?

NEIL BAROFSKY:

When I had my incident with the assistant secretary that my deputy, who had come down from-- who's another former federal prosecutor, who did narcotics work, said to me, Kevin Puvalowski. And he said to me, "Neil, you were just offered the bullet or the bribe, the gold or the lead."

And what he was referring to was a society just like that, which was Colombia, back in the day when Pablo Escobar and the drug kingpins really controlled society. And what he was referring to is that basically to corrupt society Escobar would go to a magistrate or a police officer, police chief, a politician, and say, "You have two choices. You can either take this giant pile of money and do my bidding. Or you can get the lead, a bullet in your head."

And Kevin was joking that I just received the Washington white collar equivalent of the gold or the lead. And it was funny, at the time, but that's kind of what happens in a society where the rewards and incentives are, again, nobody's getting shot in the head thank goodness. But it's a breakdown of the system.

And in some ways, it creates this false illusion that there are people out there looking out for the interest of taxpayers, the checks and balances that are built into the system are operational, when in fact they're not. And what you're going to see and what we are seeing is it'll be a breakdown of those governmental institutions. And you'll see governments that continue to have policies that feed the interests of -- and I don't want to get clichéd, but the one percent or the .1 percent -- to the detriment of everyone else.

BILL MOYERS:

You make it clear in the book that the Obama administration fought against cutting down the size of these banks. And yet, in the second debate with Mitt Romney the president said, "We passed the toughest Wall Street reform since the Great Depression." As I hear you, it wasn't all that tough.

NEIL BAROFSKY:

Well, that's a literally true statement. Because when you think of-- but it's a very low bar to clear. I mean, all of the regulatory reform since the Great Depression has been peeling back on those regulations. With really the big death knell happening in the end of the Clinton administration with, you know, a couple of bills, one that removed the last vestiges of the separation between commercial and investment banks.

BILL MOYERS:

Glass-Steagall Act?

NEIL BAROFSKY:

Glass-Steagall.

BILL MOYERS:

It took down the wall between those two?

NEIL BAROFSKY:

The last part of it. And then the second part by passing a bill that made it, essentially made derivatives out of bounds for regulation. So saying that it's the toughest is literally true. The problem is it hasn't been tough enough in where it most matters.

And again, you don't really have to take my word for it. You just look what the market has done. Based on the presumption of bailout, the banks get higher ratings from the credit rating agencies which means they can borrow money for less, because their debt is viewed by the credit rating agencies as being less risky. And they get these higher ratings on explicit presumption that the government will bail them out and make good on their debt.

So it didn't deliver the goods where it matters the most. Again, not saying that it doesn't have some good positive things for our system and for people. But it didn't deliver the most important thing that we need if we want to address the causes of the last crisis and help prevent the next one.

BILL MOYERS:

What will it take to prevent the next one?

NEIL BAROFSKY:

Got to break them up. I mean, it is not a simple thing to accomplish, necessarily. But it's a very simple solution. And what you see, I think, kind of amazingly, is how many more people have come to this view over the last year or so. It used to be a lonely perch that we sat on. Former special inspector generals, a couple of academics.

But now you have people like Sandy Weill, the architect of Citigroup. And sure, too little too late, after he made all of his money off creating these Frankenstein monsters. But even he now recognizes that we have to break up the banks. You have senior officials at the Federal Reserve recently coming out in favor of this. The vice chair of the FDIC, a very strong advocate for breaking up the banks. And you hear it a lot more in members of Congress-- that are supporting this notion. So to me, on the one hand, it's absolutely essential. If we really want to get to the point where we don't have to bailout a bank, we have to make it so that no bank is so systemically significant and large that its failure could bring down the system.

BILL MOYERS:

Are they up to their old tricks?

NEIL BAROFSKY:

The banks? Sure. I mean, you know, so we had this regulatory reform of Dodd-Frank in 2010, which, you know, left them intact and inside. But it had all of these rules and all of these regulations that needed to follow. And right now it is hand to hand, trench warfare, combat with those lobbyists spending all that money on campaign contributions, on, you know, flooding the decision makers and the regulators with comment letters and endless meetings.

And pressuring members of Congress to put pressure on the regulators, to water down the rules, to basically get as much back to the good old days where they would have free reign to print money, take advantage of their too big to fail status, bully and push out the little guys, take advantage of consumers. And that's what all of these efforts area about are to preserve these very, very core profit streams that they had before.

And that's right now is where the battle is being waged. Not on TV, you know, not necessarily out in front, but behind the scenes where the next set of rules are being forged on what they're going to be able to do and how they're going to be able to do it.

BILL MOYERS:

What are you hearing in the campaign about all this?

NEIL BAROFSKY:

Well, there's sort of two levels, right? There's the campaign rhetoric, which I think you just have to ignore. I mean, President Obama, for example, campaigned on this whole policy of no lobbyists. That he was going to take on these lobbyists when he came into office. That was in 2008.

In January 2009, do you know who they made as the chief of staff for Treasury Department? Former chief lobbyist for Goldman Sachs, Mark Patterson. So like, so you've got to look beyond what they're saying. And what they're saying is things like they're both, 100, totally convinced that they would never bailout a bank ever again. And Barack Obama says he won't do it because the Dodd-Frank mechanisms would work.

Mitt Romney is a little bit more mysterious. He says he would remove the regulatory reform and replace it with something else. But that he too would never bail out the banks again. Which again, sounds great, and I'm sure if you were to ask President Bush-- any time up until September of 2008, he would just as passionately tell you that he would never dream of bailing out the banks either.

But that's not realistic. If we're in a crisis, they're going to do exactly what they did in 2008. So you look to what are their policies? How are they going to accomplish that goal? And neither one really offers anything. Romney literally doesn't offer anything. We have no idea what his policies are. We don't know what that replacement is. But we do know, we hear him from interviews and some of his chief advisors, you know, say things like, against breaking up the banks through bringing back some of those Depression Era laws or again one of his advisors recently said that he's against having size caps, which is another way of breaking up the banks. By the way, two policies that are absolutely 100 percent identical with those of President Obama and his advisors. So neither one really has a very clear path forward to achieve that goal of making it so that it's not necessary to bailout banks once again.

BILL MOYERS:

Is it too late to reverse course?

NEIL BAROFSKY:

No, it's not too late. My sincere hope is that we get it done before the next financial crisis, because I think that the next one, given how big the banks have become and frankly how much less room we have because of the fiscal crisis, of dealing with the giant financial, that it'll be more devastating. I hope we can do it before then. But frankly, the end game for real reform has to unfortunately be in the aftermath of the next crisis.

BILL MOYERS:

In the meantime, I hope everyone reads "Bailout: An Inside Account of How Washington Abandoned Main Street While Rescuing Wall Street." Neil Barofsky, thank you very much for being with me.

NEIL BAROFSKY:

Thank you for having me.

Excerpt from Neil Barofsky's Bailout

Excerpt from Neil Barofsky's Bailout