We’re Not Making This Up!

- May 29, 2014Corporate taxes are near a 60-year low, in part because companies have become adept at not paying their fair share.

- May 16, 2014How two men used the "tobacco strategy" to try to take down an esteemed scientist because they disagreed with his conclusion that global warming is caused by greenhouse gases.

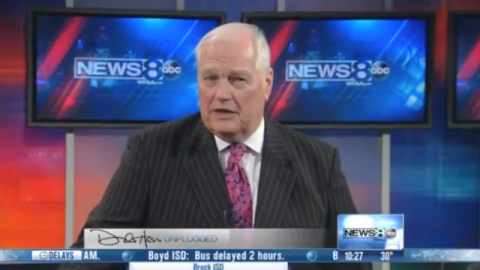

- February 13, 2014A veteran sportscaster’s remarks on the hypocrisy of NFL personnel who say Michael Sam's decision to come out will hurt him in the draft go viral and show that the times are changing.

- February 10, 2014Colleagues thought Tyrone Hayes was being paranoid, but it turned out that he had every reason to be.

- January 16, 2014We spend a fortune in welfare for those comfortably at the top.

- December 25, 2013Pope Francis tweets about the same topics he speaks about: the importance of caring for those less fortunate than ourselves and what it means to live charitably. Here's a sampling.

- December 17, 2013You can buy a poster celebrating the movement that decried capitalism's excesses from the big box store that best illustrates capitalism's excesses.

- November 14, 2013Watch spectacular performances from around the world inspired by Beethoven's "Ode to Joy."

- November 12, 2013Thanks to a loophole, some nonprofits can pay workers with disabilities as little as 22 cents an hour. Advocates for disabled workers are trying to change that.

- October 22, 2013Two of the world's most influential money managers got an earful from audience members on the needs of working class families.