Smart Charts

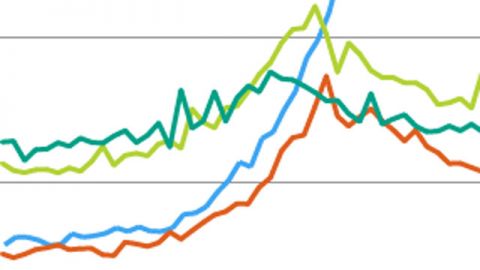

- December 24, 2013Corporate profits have rebounded while more than four million Americans have been without work for six months or longer.

- December 20, 2013Mass incarceration has become a form of legalized discrimination that makes it more difficult for millions to participate in basic aspects of our democracy.

- December 13, 2013Forget Congress: The real action after Newtown was in 40 states -- from assault weapon bans to "volunteer emergency security forces" for K-12 schools.

- November 14, 2013A new ACLU report documents the disturbing growth of endless sentences.

- October 11, 2013New research shows the US made greater gains in wealth than any other country, despite record poverty levels and stagnant wages.

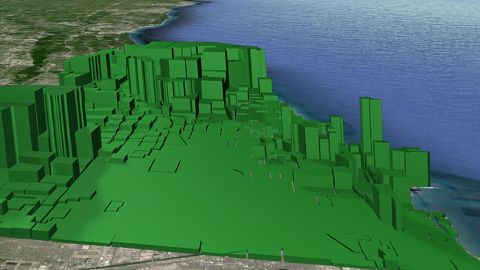

- October 10, 2013An artist re-envisions the skylines of major cities to reveal the gap between rich and poor.

- September 20, 2013A snapshot of what America's middle class used to be and what it is now in terms of wages, work and out-of-pocket costs -- and the problems caused by growing economic inequality.

- September 19, 2013If food waste was a country, its 3.3 gigatonnes of emissions would make it the third highest emitting country in the world.

- September 18, 2013A handful of very dirty power plants are responsible for a huge share of America's CO2 emissions. We mapped them.

- August 28, 2013A study looked at high-earning CEOs performances over the past 20 years and found that compensation isn't at all reflective of a job well done.