Mary Schapiro, until recently the chair of the Securities and Exchange Commission, has passed through Washington’s lengendary revolving door to a new job at Promontory Financial Group, a company well-known as a fixer in the nation’s capital. The Wall Street Journal describes Promontory as “a consulting firm that has built a reputation as a shadow regulator by hiring scores of former government officials” who help banks struggling to comply with – or influence — the rules.

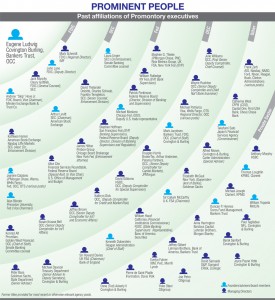

Click the chart to zoom in. Courtesy of Zero Hedge

Schapiro will join many government agency alumni at Promontory — The Wall Street Journal places the number of former regulators there at around 100. Promontory’s founder and CEO Eugene Ludwig is a former regulator himself. He served as President Clinton’s comptroller of the currency from 1993 to 1998. One of their more recent hires is Julie Williams, a key player in writing the Dodd-Frank bank reform law. She served for three decades at the Office of the Comptroller of the Currency, working at different points as the chief counsel and the acting comptroller of currency. Schapiro will also be working alongside many other former SEC staffers, including longtime Wall Streeter Arthur Levitt, who was the longest serving SEC chair, and former Acting SEC Chair Laura Unger.

Interviewed by The Wall Street Journal about her new position at Promontory, Schapiro insisted, “In my case, there’s no revolving door… I won’t be going back to government.” But that’s not exactly right.

“I guess we maybe have a difference in opinion about what the revolving door means,” says Michael Smallberg, an investigator for the government watchdog group Project on Government Oversight.

Schapiro has spent most of her career as a regulator, and has led three of the major agencies that oversee Wall Street: the government’s SEC and Commodity Futures Trading Commission, as well as FINRA, the Financial Industry Regulatory Authority, which independently monitors securities trading. She also has served as a board member at Duke Energy and Kraft Foods. And even though she hasn’t revolved between the public and private sector as often as many of her former colleagues, she will bring a Rolodex of government contacts to her new job where, according to Promontory, she will “advise clients on risk management, drawing on insights and understanding gleaned from her deep regulatory experience as well as on her service on boards of directors of major American corporations.” In other words, she’ll help banks work with the very regulators she used to supervise.

“Its not surprising, but it is illuminating and concerning,” Smallberg says. “At her confirmation hearing and during her time in office she did at least recognize some of the appearance problems that are associated with people going from the SEC to industry.”

Schapiro has sworn not to appear before the SEC on behalf of her new clients at Promontory. But, Smallberg says, “she can still do what’s referred to as ‘behind-the-scenes lobbying’ where perhaps she won’t personally be going to the SEC, but she’ll be telling her clients, ‘these are the people to contact and the types of calls you can make to be most effective.’”