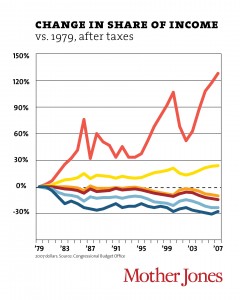

New York Times reporter Annie Lowry notes this week that a “growing body of economic research” indicates that the “yawning gap between the haves and the have nots” may be a major factor in slowing economic growth and job creation in the years ahead. A recent report from the International Monetary Fund concluded that “reducing inequality and bolstering growth may be ‘two sides of the same coin.'”

Despite the fact that income inequality has been a trend since the early 1980s, Lowry writes that economists and institutions like the IMF and the World Bank have only recently come to view economic inequality as a force driving unstable growth, rather than merely a “side effect of policies that fostered the country’s economic dynamism” — such as tax incentives for investors, among others — as previously thought.

Despite the fact that income inequality has been a trend since the early 1980s, Lowry writes that economists and institutions like the IMF and the World Bank have only recently come to view economic inequality as a force driving unstable growth, rather than merely a “side effect of policies that fostered the country’s economic dynamism” — such as tax incentives for investors, among others — as previously thought.

“The Organization for Economic Cooperation and Development this year warned about the ‘negative consequences’ of the country’s high levels of pay inequality, and suggested an aggressive series of changes to tax and spending programs to tackle it.

The I.M.F. has cautioned the United States, too. ‘Some dismiss inequality and focus instead on overall growth — arguing, in effect, that a rising tide lifts all boats,’ a commentary by fund economists said. ‘When a handful of yachts become ocean liners while the rest remain lowly canoes, something is seriously amiss.’

The concentration of income in the hands of the rich might not just mean a more unequal society, economists believe. It might mean less stable economic expansions and sluggish growth.

That is the conclusion drawn by two economists at the fund, Mr. Ostry and Andrew G. Berg. They found that in rich countries and poor, inequality strongly correlated with shorter spells of economic expansion and thus less growth over time.”

Even the editors at The Economist fell in line offering a manifesto of sorts in this week’s issue of the magazine, entitled “True Progressivism.” Their special report calls for a “new form of radical centrist politics… to tackle inequality without hurting economic growth.”

The agenda includes a three-point plan that “steals ideas from both left and right” and advocates “Rooseveltian attacks on monopolies” (including big banks), better targeting of government spending on the poor, the elderly and the young (means-testing, raising retirement ages, investing in pre-school education) and tax reforms (eliminating deductions that “particularly benefit the wealthy”).

The issue has already generated a lively discussion online including hundreds of comments on their website, as well as a scathing retort from New American Foundation cofounder Michael Lind (who calls The Economist‘s progressivism “phony”) in Salon.

Demos Policy Shop blogger Jennifer Wheary notes that:

Raising an alarm about inequality and advocating these types of solutions is nothing new. What has changed is the volume of voices now participating in the conversation. For anyone but a presidential candidate, 2012 seems to have thus far been a conscious-raising year for the inequality issue.

We welcome that debate of new ideas. As Wheary concludes in her post, it’s “better to battle about what to do about inequality than to sweep the matter under the rug.”