If you groan about tax day, you’re certainly not alone.

But what if tax day was something we could be proud of as members of a democracy? Would you feel differently about paying taxes if you knew they were going to support public services that you, your family and your community rely on — such as public safety, roads and bridges, schools, health care, social services and national parks?

Millions of Americans file their federal income tax returns in April each year with no idea what the government actually does with all that money.

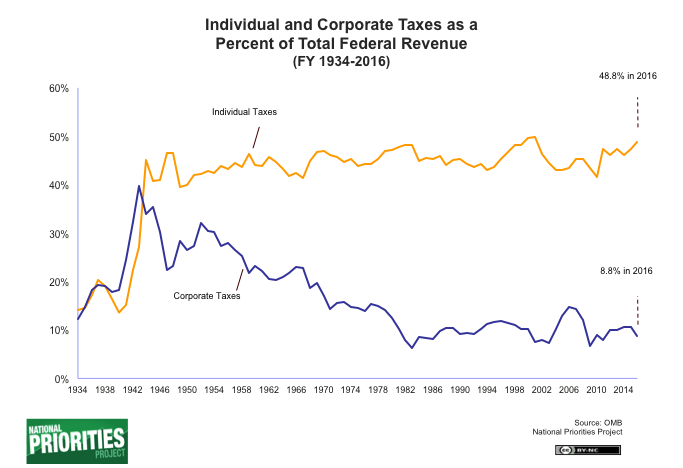

This is surprising, considering that individuals are our nation’s primary bill payers. Income taxes paid by individuals account for 49 percent of all federal tax revenues, which are projected to be $2.99 trillion in 2016. Other tax revenue comes from payroll taxes paid jointly by workers and employers, accounting for 33 percent and corporate income taxes paid by businesses, which make up 9 percent.

Given how much taxpayers collectively contribute to our nation’s revenue stream, it goes without saying that we should be able to influence how the government spends that money. Unfortunately, that’s not always the case. The federal government doesn’t make it easy to find out where your tax money goes.

That’s why the National Priorities Project (NPP) has done the work for you.

Using a customized tax receipt calculator, you can find out exactly how the federal government spent each penny of your 2016 taxes. Look up your tax receipt right now — is your money going where you think it should?

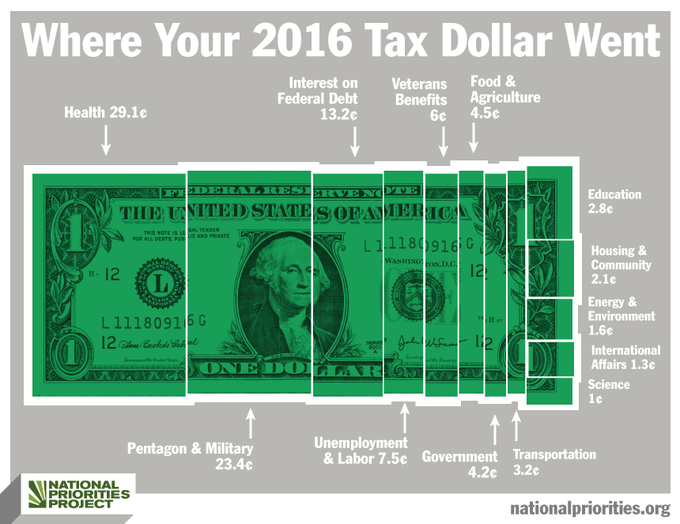

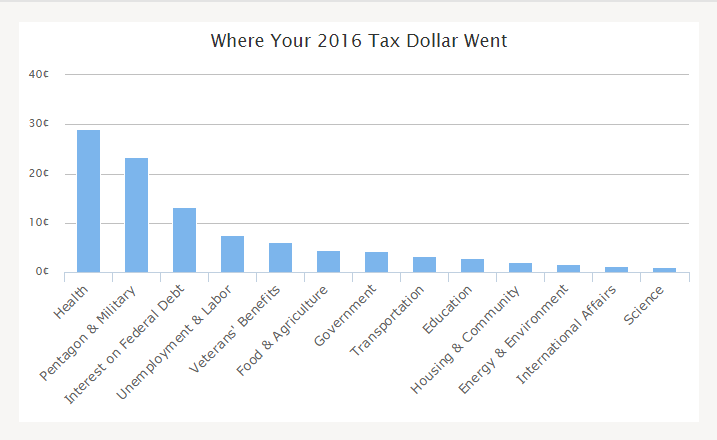

Across the United States, the average taxpayer paid $14,051 in 2016 federal income taxes.

Health care received the largest share of that sum, $4,090, for programs like Medicaid and the Children’s Health Insurance Program, followed by the military, which received $3,290. Meanwhile, only $398 went to education programs.

NPP has also looked at each state’s average taxpayer and calculated where taxes from every state are going. These state-by-state tax receipts show the state with the highest average taxes paid (Connecticut, $22,787) and lowest (West Virginia, $8,607) and everything in between.

Although these state receipts show the average taxpayer’s contribution to the budget, Americans don’t all pay taxes equally. In theory the tax code is progressive, meaning those who make more money pay higher tax rates — yet in practice that’s not always the case. As Warren Buffett made famous, billionaires sometimes pay lower rates than middle-class workers. And some corporations, like General Electric and PG&E, have gotten away with paying zero federal income taxes, even when they make billions in profit. That’s because the tax code is chock-full of tax breaks.

According to Pew Research, tax breaks overwhelmingly go to top earners and corporations, and they add up. “We counted 118 individual breaks with a net total estimated cost in fiscal 2016 of nearly $1.15 trillion, compared with 80 corporate breaks totaling $185.2 billion.” That’s in part because tax deductions — one important type of tax break — are far more likely to benefit the wealthy than middle- and low-income folks, because deductions only offer savings to taxpayers who itemize deductions. Only 16 percent of households making between $25,000 and $30,000 itemize tax deductions, while nearly 100 percent of those making over $200,000 itemize.

Tax day is an opportunity to draw attention to some of the central budget policy choices facing our nation. How should our tax dollars be spent? Who should pay more or less in taxes? Is Congress listening to what Americans think are top spending priorities?

As primary investors in our nation, we should all speak up with our own opinions on these questions. Making our priorities clear to lawmakers in Congress is a key part of making tax day something we can be proud of, even as we groan about filling out all those IRS forms.

This post first appeared at the Campaign for America’s Future blog, OurFuture.org. and was updated by BillMoyers.com staff on April 5, 2017, to reflect new figures.