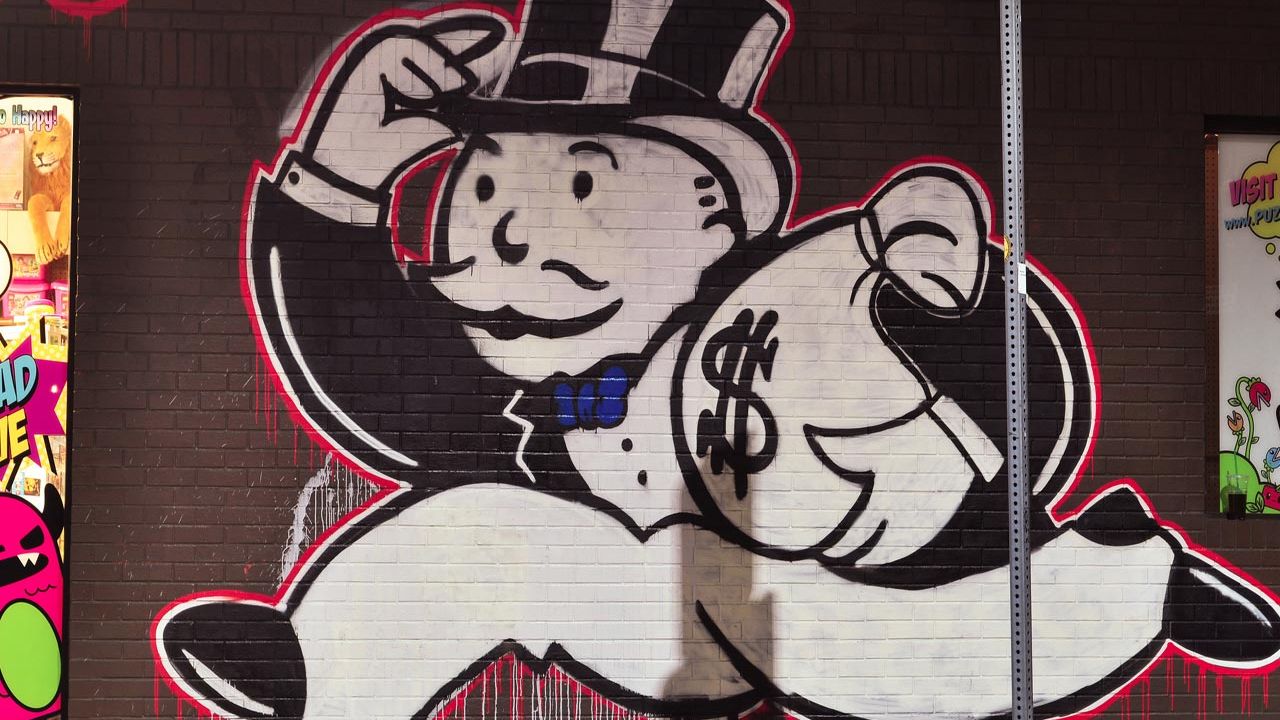

We’re missing billions in taxes each year. That’s partly why our roads and transit systems are falling apart. (Mural by graffiti artist Alec Monopoly / Photo by aisletwentytwo | Flickr CC 2.0)

David Sirota has a well-earned reputation as a truth-teller — an heir to I.F. Stone. We are featuring his newsletter here for the first time. He’s taken a deep look into this week’s news has come up with a theme. The word of the week is looting.

In this Orwellian era, working-class people pilfering convenience store goods is called “looting,” while rich people stealing hundreds of billions of dollars is deemed good “public policy”—David Sirota

Headlines this morning are all about looting — specifically, looting in Minneapolis, after the police killing of an unarmed African American man was caught on video. In the modern vernacular, that word “looting” is loaded — it comes with all sorts of race and class connotations. And we have to understand that terms like “looting” are an example of the way our media often imperceptibly trains us to think about economics, crime and punishment in specific and skewed ways.

Working-class people pilfering convenience-store goods is deemed “looting.” By contrast, rich folk and corporations stealing billions of dollars during their class war is considered good and necessary “public policy” — aided and abetted by arsonist politicians in Washington lighting the crime scene on fire to try to cover everything up.

To really understand the deep programming at work here, consider how the word “looting” is almost never used to describe the plundering that has become the routine policy of our government at a grand scale that is far larger than a vandalized Target store.

Indeed, if looting is defined in the dictionary as “to rob especially on a large scale” using corruption, then these are 10 examples of looting that we rarely ever call “looting”:

1. The Fed Bailed Out the Investor Class: “Thanks to this massive government subsidy, large companies like Boeing and Carnival Cruises were able to avoid taking money directly — and sidestep requirements to keep employees on.”

2. Millionaires To Reap 80% of Benefit From Tax Change In Coronavirus Stimulus: “The change — which alters what certain business owners are allowed to deduct from their taxes — will allow some of the nation’s wealthiest to avoid nearly $82 billion of tax liability in 2020.”

3. Stealth Bailout’ Shovels Millions of Dollars to Oil Companies: “A provision of the $2.2 trillion stimulus law gives (companies) more latitude to deduct recent losses… The change wasn’t aimed only at the oil industry. However, its structure uniquely benefits energy companies that were raking in record profits.”

4. The Tax-Break Bonanza Inside the Economic Rescue Package: “As part of the economic rescue package that became law last month, the federal government is giving away $174 billion in temporary tax breaks overwhelmingly to rich individuals and large companies.”

5. Wealthiest Hospitals Got Billions in Bailout for Struggling Health Providers: “Twenty large chains received more than $5 billion in federal grants even while sitting on more than $100 billion in cash.”

6. Airlines Got the Sweetest Coronavirus Bailout Around: “The $50 billion the government is using to prop up the industry is a huge taxpayer gift to shareholders.”

7. Large, Troubled Companies Got Bailout Money in Small-Business Loan Program: “The so-called Paycheck Protection Program was supposed to help prevent small companies from capsizing as the economy sinks into what looks like a severe recession…But dozens of large but lower-profile companies with financial or legal problems have also received large payouts under the program.”

8. Public Companies Received $1 Billion Meant For Small Businesses: “Recipients include 43 companies with more than 500 workers, the maximum typically allowed by the program. Several other recipients were prosperous enough to pay executives $2 million or more.”

9. Firms That Left U.S. to Cut Taxes Could Qualify for Fed Aid: “Companies that engaged in so-called corporate inversion transactions while maintaining meaningful U.S. operations appear to be eligible for two new programs.”

10. The K Street Bailout: “Lobbyists already got bailed out, in effect, when corporations got bailed out. This is kind of the ultimate in double dipping; corporations are nursed back to health by the sheer force of Federal Reserve commitments, this allows them to keep their lobbying expenses up, and then lobbyists lobby for free money for themselves.”

All of this looting is having a real-world effect: As half a billion people across the globe could be thrown into poverty and as 43 million Americans are projected to lose their health care coverage, CNBC reports that “America’s billionaires saw their fortunes soar by $434 billion during the U.S. lockdown between mid-March and mid-May.”

Apparently, though, all of that pillaging is not enough. The looting is now getting even more brazen: President Trump is floating a new capital gains tax cut for the investor class, while the New York Times notes that House Speaker Nancy Pelosi’s new proposal “to retroactively lift a limit on state and local tax deductions would largely funnel money to relatively high earners.”

We don’t call this “looting” because it is being done quietly in nice marbled office buildings in Washington and New York.

We don’t call this “looting” because the looters wear designer suits and are very polite as they eagerly steal everything not nailed down to the floor.

We don’t call this “looting” but we should — because it is tearing apart our nation’s social fabric, laying waste to our economy and throwing our entire society into chaos.