(Photo by Pictures of Money/ Flickr CC 2.0)

This post first appeared at Institute for Policy Studies.

Wall Street banks handed out $23.9 billion in bonuses to their New York City-based employees last year, according to new figures from the New York State Comptroller. To put these figures in perspective, we’ve compared the Wall Street payout to low-wage workers’ earnings.

For full sources and methodology, download the full report [PDF].

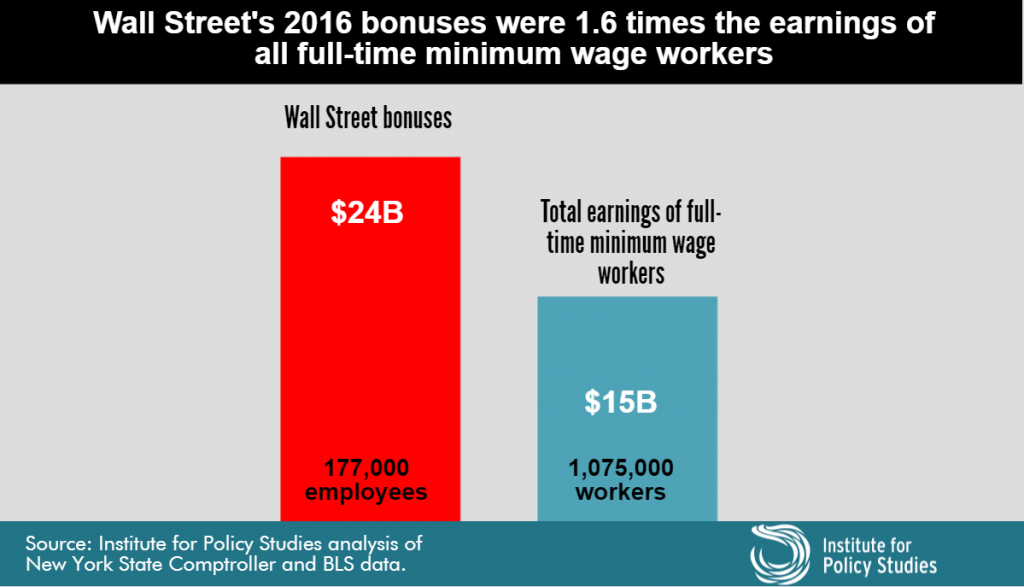

The total bonus pool for 177,000 Wall Street employees was 1.6 times the combined annual earnings of all 1,075,000 US full-time minimum-wage workers.

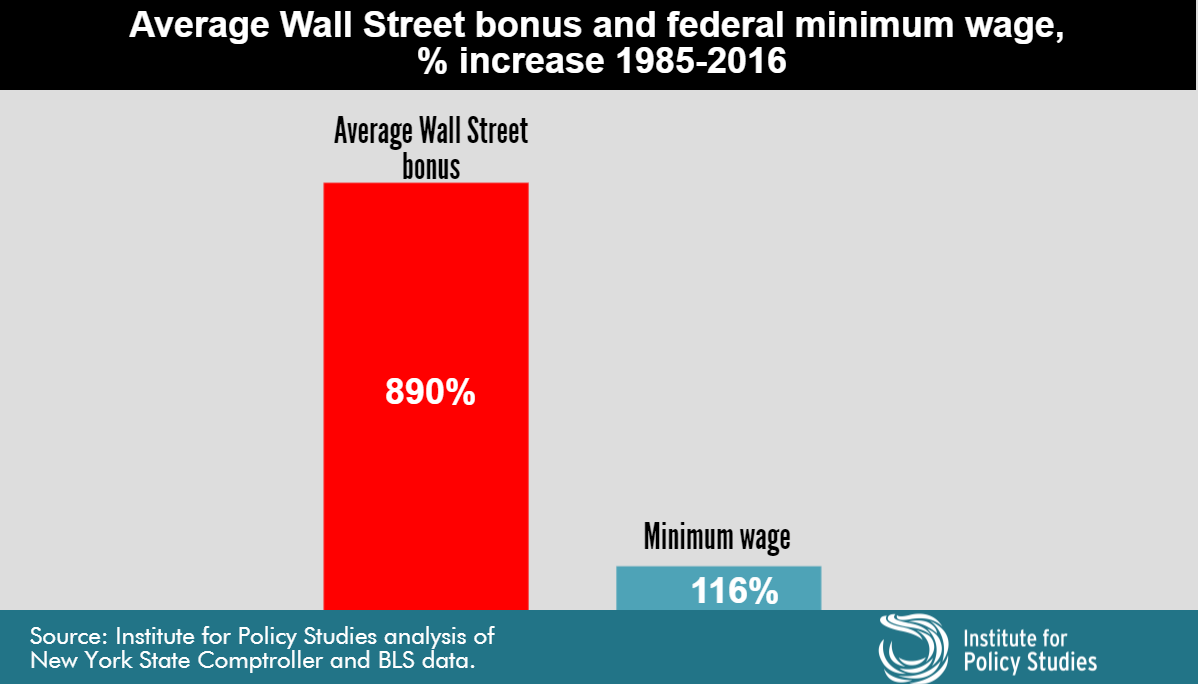

The average Wall Street bonus increased by 1 percent last year to $138,210. Since 1985, the nominal value of the average Wall Street bonus has increased 890 percent, whereas the minimum wage has risen only 116 percent.

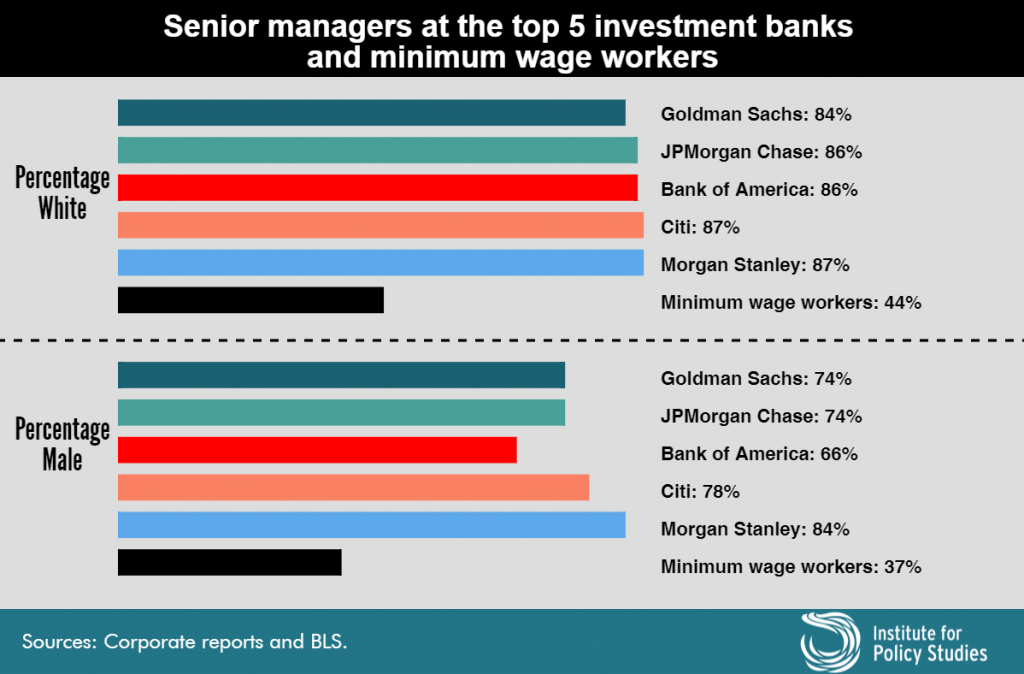

The much faster increase in Wall Street bonuses has contributed to racial and gender inequality, since workers at the bottom of the wage scale are predominantly people of color and female, whereas those in the financial industry’s upper echelons are overwhelmingly white and male.

- At the five largest US investment banks, the share of executives and top

managers who are white ranges from 84-87 percent, and the share who are male

ranges from 66-84 percent. - Only 44 percent of minimum wage workers are white and 37 percent are male.

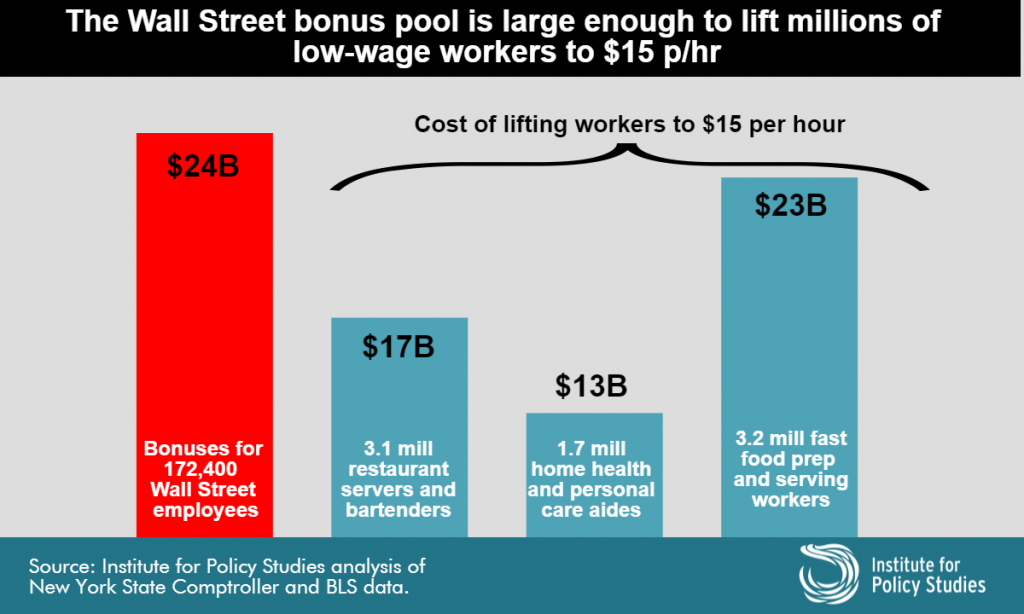

The 2016 bonus pool held enough dollars to lift the pay of any one of these groups of low-wage workers up to $15 per hour:

- all of the country’s 3.1 million restaurant servers and bartenders,

- all 1.7 million home health and personal care aides, or

- all 3.2 million fast food preparation and serving workers

Wall Street Bonuses versus Minimum Wage Earners

Wall Street banks doled out $23.9 billion in bonuses to their 177,000 New York-based employees, which amounts to 1.6 times the combined earnings of all 1,075,000 Americans who work full-time at the current federal minimum wage of $7.25 per hour.

The average Wall Street bonus increased by just 1 percent last year. But the nominal value of the average bonus has grown by 890 percent since 1985, from $13,970 to $138,210. Meanwhile, the minimum wage has risen only 116 percent, from $3.35 per hour to $7.25. Adjusted for inflation, the minimum wage was nearly 3 percent lower in 2016 than in 1985, whereas the average bonus was about 343 percent higher.

The Race and Gender Divide

Over the past three decades, the dramatic rise in average financial industry bonuses relative to the minimum wage has contributed to racial and gender inequality. Workers at the bottom of the national wage scale are predominantly people of color and female, whereas those in Wall Street’s upper echelons are overwhelmingly white and male. At the top five US investment banks (JPMorgan Chase, Goldman Sachs, Bank of America Merrill Lynch, Morgan Stanley and Citigroup), the share of executives and top managers who are white ranges from 84 to 87 percent and the share who are male ranges from 66 to 84 percent, according to the firms’ own reports (see sources section). By contrast, only 44 percent of minimum-wage workers are white and an even smaller share, just 37 percent, are male.

For Wall Street employees, annual bonuses come as an extra reward on top of their base salaries, which averaged $388,000 in 2015, the most recent year for which data are available. According to the New York State Comptroller, this is five times higher than the average salary for other New York City private sector employees. On top of their cash salary and bonuses, top Wall Street executives also typically receive massive stock options and grants, most of which are deemed fully deductible “performance based” pay and thus fully tax-deductible for the firm. According to a 2016 Institute for Policy Studies report, the top 20 US banks paid out more than $2 billion in fully deductible performance pay to their top five executives between 2012 and 2015. At a 35 percent corporate tax rate, this translates into a tax break of more than $725 million, or $1.7 million per executive per year.

Wall Street Bonuses versus Low-Wage Service Workers

While living wage campaigns have been successful in many cities, Oxfam and the Economic Policy Institute report that 44 percent of US workers still earn less than $15 per hour. This is the wage level needed to cover basic living costs in most areas of the country, according to the National Employment Law Project. The Wall Street bonus pool was large enough in 2016 to have lifted all of America’s 3.2 million fast food prep and serving workers up to $15 per hour — and still have had $776 million left over. Or that bonus pool could have raised to $15 the hourly wage of all our nation’s 1.7 million home care aides or all of our 3.1 million restaurant servers and bartenders.

Shifting resources into the pockets of low-wage workers would give the American economy a much bigger bang for the buck than increases in Wall Street bonuses. To meet basic needs, the low-wage workers who prepare our food and take care of the elderly tend to spend nearly every dollar they earn, creating beneficial economic ripple effects. The wealthy, by contrast, can afford to squirrel away more of their earnings. The Wall Street bonus season may coincide with an uptick in luxury goods sales, but a minimum wage hike would give America’s economy a much greater boost.

Wall Street Bonus Reform Long Overdue

Huge Wall Street bonus payouts also encourage the sorts of high-risk behaviors that led to the 2008 financial crisis. And yet financial regulators have still not implemented a Wall Street bonus reform law that has been on the books for nearly seven years. Section 956 of the 2010 DoddFrank financial reform legislation prohibits financial industry pay packages that encourage “inappropriate risks.” Regulators were supposed to implement this new rule within nine months of the law’s passage.

In 2011, regulators issued a proposed rule that did not go far enough to prevent the type of behavior that led to the 2008 crash. As spelled out in detail in Institute for Policy Studies comments to the SEC, the proposed rule falls short in several areas, including overly lenient bonus deferrals, weak stock-based pay restrictions, and enforcement proposals that leave too much discretion to bank managers. While regulators responded to criticism by agreeing to issue a new proposal, this work was not completed before the end of the Obama administration. And now with Republican control of both Congress and the White House, there is a strong chance it will be postponed indefinitely. House Republican leadership introduced a bill in the last session to repeal most of the Dodd-Frank reform package, including the Wall Street pay provision. President Donald Trump has also vowed to “do a big number” on the landmark financial reform legislation. In the meantime, the Wall Street bonus culture that contributed to the 2008 financial crisis continues to flourish.