Smart Charts

- June 6, 2014When it comes to financing the public sector, who bears the burden is the crucial question.

- May 22, 2014We haven't come very far at all since the civil rights victories of the 1960s.

- May 22, 2014The unemployment rate for black college graduates has been higher than for all graduates for decades. A new report says that the gap has widened since 2007.

- May 12, 2014The "open Internet" is no match for revolving doors and buckets of cash.

- May 9, 2014The amount of CO2 in the atmosphere fluctuates naturally over time -- but not by this much.

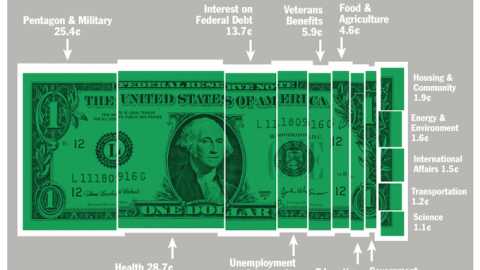

- April 14, 2014 | Updated April 14, 2016Individuals taxpayers will give the IRS its biggest boost on April 18, so we should know what the government is doing with our money (but that doesn't mean we have to like it).

- April 10, 2014It wasn't long ago when Democrats and Republicans in Congress shared some ideological overlap.

- January 17, 2014The percentage of Republicans that believe humans evolved over time has dropped significantly in the past four years.

- January 8, 2014The war on poverty helped raise millions above the poverty line, but where do we stand today?

- December 31, 2013College graduates who borrowed for bachelor's degrees granted in 2012 have an average student loan debt of $29,400