This week, Arthur Brooks, president of the American Enterprise Institute, tells Bill Moyers about his quest to formulate a new kind of “compassionate conservatism.”

Brooks acknowledges that the American right “traditionally doesn’t even talk about poverty,” but ascribes equal blame to the left for “talking about solutions,” while offering “no implementable answers that actually help poor people.”

Brooks is wrong on that second point, as we’ll see below.

His larger problem is a fundamental one for compassionate conservatives: They don’t acknowledge that the core problem for the poor is that they don’t have enough money. So while his compassion may be laudable, Brooks’ conservatism leads him to oppose any policy that would put more money in the pockets of Americans at the lower end of the economic ladder, either through public spending or measures that would compel American companies — now seeing record profits — to share the wealth with their workers who don’t have high-end skills.

That’s apparent in Brooks’ dismissal of the plight of millions of low-wage American workers. “We don’t have a low-wage problem,” he tells Moyers. “We have an unemployment problem in the bottom 50 percent [of the labor market].”

The fatal flaw in that argument is that the two problems are inextricably intertwined. “The data are crystal clear on this point,” says Jared Bernstein, who served as chief economic advisor to Vice President Joe Biden and is now a senior fellow at the Center for Budget and Policy Priorities. “Weak labor demand, as in high unemployment, is a key factor in suppressing wage gains at the low end of the job market. It takes full employment for employers to bid up the compensation of low-wage workers.”

Economist Dean Baker, co-director of the progressive Center for Economic and Policy Research, recently wrote a book with Bernstein titled, Getting Back to Full Employment: A Better Bargain for Working People, which detailed their research into the relationship between wages and unemployment. He tells BillMoyers.com that in the tight labor market at the end of the 1990s — when unemployment dipped below 4 percent — low-wage workers saw more than income gains. “The business press was full of pieces about companies offering child care or flex-work arrangements to keep and attract workers. They were chartering buses to take people from inner city neighborhoods to jobs at restaurants and hotels in the suburbs. In a tight labor market even workers with little education will be in demand.”

Today, the root of these interconnected problems is what economists call the “output gap,” which is the difference between the economy’s real output — the value of all the goods and services we’re creating — and its potential. Economy Watch estimates that the US output gap in 2013 was -3.48 percent, meaning that our economy hummed along at around $600 billion below its potential.

That’s largely a result of slack in consumer demand that has persisted since the beginning of the Great Recession. And here we run into a vicious cycle: After 30 years of stagnant wages — and the crash’s loss of millions of jobs and billions of dollars in wealth — we’re not spending enough to get back to full employment. That means there’s little incentive for businesses to offer more pay for those at the bottom. It’s still relatively easy to find people who will work service jobs for poverty wages.

It’s here that Brooks’ conservative allies are primarily culpable for the persistence of these intertwined problems. In past downturns, that vicious cycle was broken with robust public spending — the government was the “buyer of last resort” when consumers were too tapped out to buy stuff or head out on the town.

But in the Obama era, the conservative movement has not only rejected deficit spending to kick-start the economy, they’ve relentlessly pushed budget cuts in the name of “deficit reduction.” Brooks may lament unemployment, but the reality is that Republicans have repeatedly demanded spending cuts in the face of a demand problem, going so far as to shut down the government and threaten to breach the debt limit to get them. Some Democrats joined in the right’s baseless deficit hysteria, but liberals have rejected it and consistently called for more stimulus to pump up demand.

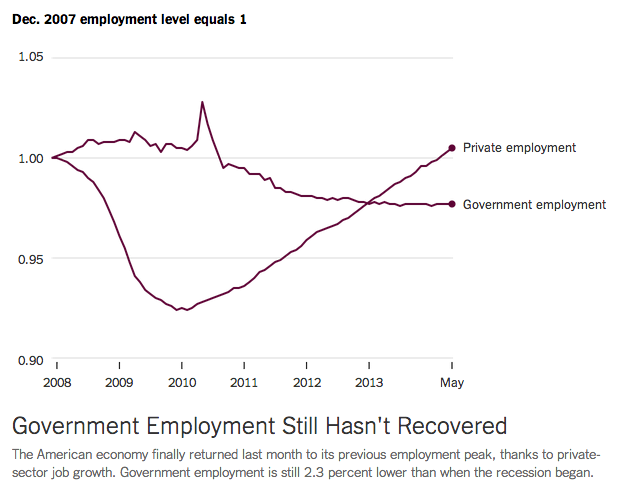

The result, as David Leonhardt noted in The New York Times last month, is that while private sector employment surpassed pre-recession levels for the first time back in March, “the public sector — federal, state and local government — still isn’t close to returning to its pre-recession employment levels.”

(Chart: New York Times, Data: Bureau of Labor Statistics)

All of those laid-off public employees are now in the private sector, adding to both the problem Brooks acknowledges — unemployment — and the one he dismisses: low wages.

There are other ways to intervene in that vicious cycle of unemployment and low wages. You can give tax credits to people lower on the income ladder. And Brooks and Moyers agreed that expanding the earned income tax credit would be a valuable policy. Brooks said, “It’s a great policy.”

Now, the problem is, it excludes single men. Especially those who have non-custodial parenting relationships with their children. It excludes them. These are the people who are most marginalized in the workforce today. These are the people who are most vulnerable. We need to expand it to include those people. We need to expand it such that people who are working, working honestly.

But while Brooks blames both liberals and conservatives for the suffering of the working poor, he doesn’t acknowledge that the earned income tax credit that once enjoyed support across the ideological spectrum has become a partisan issue. While conservatives continue to praise the idea of expanding the credit — which Obama included in his budget proposal — they refuse to spend any money on it. As The Atlantic’s Matthew O’Brien put it: “blame the tyranny of the deficit hawks.” The Republican budget plan authored by Rep. Paul Ryan (R-WI), which the vast majority of House Republicans support, would cut the EITC. (Ryan’s new “anti-poverty” plan would expand the EITC, but he’d “pay for it” by cutting other anti-poverty programs.)

An alternative to income subsidies is hiking the minimum wage, which after adjusting for inflation is currently $3.44 per hour less than it was at its peak value in 1968.

But Brooks is especially critical of calls to raise the minimum, arguing that a hike would be a job-killer that “hurts the people it’s supposed to help.” This is Brooks’ prime example of the left not offering “implementable answers that actually help poor people.”

And while Brooks may be trying to forge a new kind of conservatism, he relies on the same old arguments against the minimum wage that the fast food and retail industries have relied on for years.

Brooks claims that “the idea that [low-wage workers hold] dead-end jobs is not correct. The truth of the matter is that I started out in a dead-end job, I bet you started out in a dead-end job.” But a 2006 study by the Bureau of Labor Statistics found that “low-wage workers remain in low-wage jobs because higher paying jobs are not available (demand-side constraints), discrimination exists (sociological or institutional limitations), or workers do not pursue or do not qualify for higher pay (attitudinal, ability, or educational causes).” And a 2013 report by the National Employment Law Project found that claims that minimum wage jobs in the fast food industry are simply stepping stones to bigger and better things “are not supported by the facts.”

Brooks says raising the minimum wage “would of course throw people out of work who are the most marginalized members of the workforce,” and would then “be entirely on the public dole at that point.” But according to the Congressional Budget Office (CBO), raising the minimum to $10.10 per hour would eliminate a maximum of 500,000 jobs while raising the incomes of 17 million Americans. And a number of economists disputed the CBO’s job-loss estimate as being far too dire. As for those 500,000 who might end up “entirely on the dole,” studies have shown that workers at a single Wal-Mart receive as much as $900,000 in Medicaid, food stamps and other assistance, and that low-wage workers in the fast-food industry alone claim $7 billion per year in public benefits.

With ideological objections to both public spending and mandates on employers, the only other way to truly help put more money in the pockets of low-income workers would be to make it easier to unionize — which would also increase upward mobility. But that idea is anathema to the conservative movement and the American Enterprise Institute’s corporate funders. Brooks says that raising the minimum wage would increase incomes “artificially, not according to market forces,” but union-busting is arguably the leading way that corporate America keeps wages artificially low — there is no “natural market wage” for an individual worker without a lot of education who is forced to negotiate on her own with a huge company.

Arthur Brooks deserves credit for starting a conversation about the plight of the working poor in America. But his compassion can’t overcome his ideological belief that “free enterprise” unhindered by regulation is the antidote to poverty. He rightly decries the jobs crisis, but his prescriptions mirror that of the most famous “compassionate conservative,” George W. Bush, who left office with the worst record of job creation since the Labor Department started keeping payroll records in 1939.