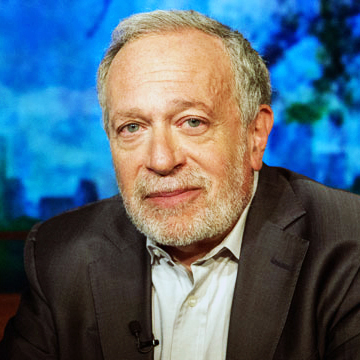

This post first appeared at Robert Reich blog.

Workers assemble Volkswagen Passat sedans at the German automaker’s plant in Chattanooga, Tenn. (AP Photo/Erik Schelzig, file)

Jobs are coming back, but pay isn’t. The median wage is still below where it was before the Great Recession. Last month, average pay actually fell.

What’s going on? It used to be that as unemployment dropped, employers had to pay more to attract or keep the workers they needed. That’s what happened when I was labor secretary in the late 1990s.

It still could happen – but the unemployment rate would have to sink far lower than it is today, probably below 4 percent.

Yet there’s reason to believe the link between falling unemployment and rising wages has been severed.

For one thing, it’s easier than ever for American employers to get the workers they need at low cost by outsourcing jobs abroad rather than hiking wages at home. Outsourcing can now be done at the click of a computer keyboard.

Besides, many workers in developing nations now have access to both the education and the advanced technologies to be as productive as American workers. So CEOs ask, why pay more?

Meanwhile here at home, a whole new generation of smart technologies is taking over jobs that used to be done only by people. Rather than pay higher wages, it’s cheaper for employers to install more robots.

Not even professional work is safe. The combination of advanced sensors, voice recognition, artificial intelligence, big data, text-mining and pattern-recognition algorithms is even generating smart robots capable of quickly learning human actions.

In addition, millions of Americans who dropped out of the labor market in the Great Recession are still jobless. They’re not even counted as unemployment because they’ve stopped looking for work.

But they haven’t disappeared entirely. Employers know they can fill whatever job openings emerge with this “reserve army” of the hidden unemployed – again, without raising wages.

Add to this that today’s workers are less economically secure than workers have been since World War II. Nearly one out of every five is in a part-time job.

Insecure workers don’t demand higher wages when unemployment drops. They’re grateful simply to have a job.

To make things worse, a majority of Americans have no savings to draw upon if they lose their job. Two-thirds of all workers are living paycheck to paycheck. They won’t risk losing a job by asking for higher pay.

Insecurity is now baked into every aspect of the employment relationship. Workers can be fired for any reason, or no reason. And benefits are disappearing. The portion of workers with any pension connected to their job has fallen from over half in 1979 to under 35 percent today.

Workers used to be represented by trade unions that utilized tight labor markets to bargain for higher pay. In the 1950s, more than a third of all private-sector workers belonged to a union. Today, though, fewer than 7 percent of private-sector workers are unionized.

None of these changes has been accidental. The growing use of outsourcing abroad and of labor-replacing technologies, the large reserve of hidden unemployed, the mounting economic insecurities and the demise of labor unions have been actively pursued by corporations and encouraged by Wall Street. Payrolls are the single biggest cost of business. Lower payrolls mean higher profits.

The results have been touted as “efficient” because, at least in theory, they’ve allowed workers to be shifted to “higher and better uses.” But most haven’t been shifted. Instead, they’ve been shafted.

The human costs of this “efficiency” have been substantial. Ordinary workers have lost jobs and wages and many communities have been abandoned.

Nor have the efficiency benefits been widely shared. As corporations have steadily weakened their workers’ bargaining power, the link between productivity and workers’ income has been severed.

Since 1979, the nation’s productivity has risen 65 percent, but workers’ median compensation has increased by just 8 percent. Almost all the gains from growth have gone to the top.

This is not a winning corporate strategy over the long term because higher returns ultimately depend on more sales, which requires a large and growing middle class with enough purchasing power to buy what can be produced.

But from the limited viewpoint of the CEO of a single large firm, or of an investment banker or fund manager on Wall Street, it’s worked out just fine – so far.

Low unemployment won’t lead to higher pay for most Americans because the key strategy of the nation’s large corporations and financial sector has been to prevent wages from rising.

And, if you hadn’t noticed, the big corporations and Wall Street are calling the shots.

The views expressed in this post are the author’s alone, and presented here to offer a variety of perspectives to our readers.