Do you ever wish it were 1999? A new century to look forward to, lots of fun Y2K speculation and perhaps most importantly — more money.

Today, the typical American family makes less than it did in 1999, significantly less in fact. Real median household income — adjusted for inflation — was $51,939 in 2013; but in 1999 it was $56,895! That’s almost $5,000 more for a family to spend on food, housing, education, healthcare and other expenses. It’s perhaps not surprising that the poverty rate has risen, for the most part, as incomes have declined. Today, over 45 million Americans or 14.5 percent of our population live in poverty.

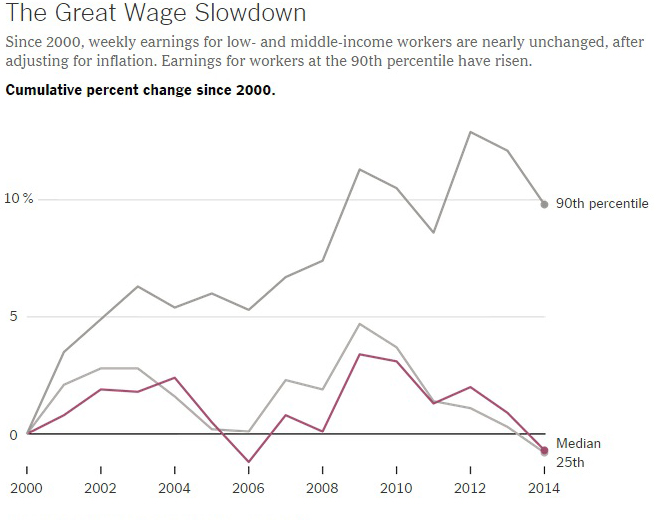

On Tuesday, The New York Times’ David Leonhardt covered the problem of shrinking paychecks in “The Great Wage Slowdown of the 21st Century.”

Leonhardt pointed out that even though the unemployment rate has fallen in the last few years, wages have barely budged. And the jobs report out last week found that while the unemployment rate fell below six percent in the past year, which is good news, hourly pay has risen just over two percent, and inflation eats away at most of that increase.

(Source: The New York Times)

Last week in a speech at Northwestern University, President Obama said he believes “over the next 10 years we’ll build an economy where wage growth is stronger than it was in the past three decades.” Here’s what Leonhardt had to say about Obama’s prediction:

He may or may not be right about that. But the speech laid out the issues in unusually clear terms. And by any definition, the great wage slowdown – or its end – is one of the most important subjects in the country today.

You can think of Mr. Obama’s argument as falling into two categories (even if he didn’t say so): the reasons that overall economic growth may accelerate, and the reasons that middle- and low-income workers may benefit more from that growth than they have lately. Both factors have contributed to the wage slowdown. The size of the pie hasn’t been growing very fast, and most of the increases have gone to a small share of already well-fed families.

On the growth side of the ledger, both energy and education have been problems. The cost of energy, after temporarily falling in the 1990s, returned to its post-1970s norm in recent years and acted like a tax on the rest of the economy. Education, meanwhile, is the lifeblood of economic growth, allowing people to do entirely new tasks (cure a disease, invent the Internet) or to do old ones with less time and expense. Yet educational attainment has slowed so much that the United States has lost its once-enormous global lead.

And the number of high-school and college graduates is rising. The financial crisis deserves some perverse credit, because it sent people fleeing back to school, much as the Great Depression did. But some of the efforts to improve school performance – by raising standards and accountability – are also playing a role.

Read the complete article at The New York Times »