James Earle Fraser’s statue The Authority of Law, which sits on the west side of the United States Supreme Court building, on the south side of the main entrance stairs. (Image: UpstateNYer, Wikicommons)

This first appeared at Washington Monthly.

Late last year a massive data hack at Target exposed as many as 110 million consumers around the country to identity theft and fraud. As details of its lax computer security oversight came to light, customers whose passwords and credit card numbers had been stolen banded together to file dozens of class-action lawsuits against the mega-chain-store company. A judge presiding over a consolidated suit will now sort out how much damage was done and how much Target may owe the victims of its negligence. As the case proceeds, documents and testimony pertaining to how the breach occurred will become part of the public record.

All this may seem like an archetypical story of our times, combining corporate misconduct, cyber-crime and high-stakes litigation. But for those who follow the cutting edge of corporate law, a central part of this saga is almost antiquarian: the part where Target must actually face its accusers in court and the public gets to know what went awry and whether justice gets done.

Two recent US Supreme Court rulings — AT&T Mobility v. Concepcion and American Express v. Italian Colors Restaurant have deeply undercut these centuries-old public rights, by empowering businesses to avoid any threat of private lawsuits or class actions. The decisions culminate a thirty-year trend during which the judiciary, including initially some prominent liberal jurists, has moved to eliminate courts as a means for ordinary Americans to uphold their rights against companies. The result is a world where corporations can evade accountability and effectively skirt swaths of law, pushing their growing power over their consumers and employees past a tipping point.

To understand this new legal environment, consider, by contrast, what would have happened if Amazon had exposed its 215 million customer accounts to a security breach similar to Target’s. Since Amazon has taken advantage of the court’s recent decisions, even Amazon users whose bank accounts were wiped clean as a direct result of the hack would not be able to take the company to court. “The lawsuits against Target would almost certainly not be possible against Amazon,” says Paul Bland, executive director of Public Justice. “It’s got its ‘vaccination against legal accountability’ here.”

Following the 2011 and 2013 Supreme Court rulings, dozens of other giant corporations — from Comcast and Wells Fargo to Ticketmaster and Dropbox — have secured the same legal immunity. So have companies ranging from airlines, gyms, payday lenders and nursing homes, which have quietly rewritten the fine print of their contracts with consumers to include a shield from lawsuits and class actions. Meanwhile, businesses including Goldman Sachs, Northrop Grumman, P. F. Chang’s and Uber have tucked similar clauses into their contracts with workers.

Hastily clicking through terms of service is now all it can take to surrender your rights to these companies. Once you do, your only path for recourse if you’re harmed by any one of them is “mandatory arbitration,” where the arbitrator is often chosen by the corporation you’re challenging, and any revelations about the company’s wrongdoing tend to be kept secret. Rather than band together under the light of the public courtroom, each individual has to work through the darkness of a private tribunal, alone, where arbitrators can interpret laws however they wish. Certain inalienable rights, the court has ruled, are actually kind of alienable.

The court decisions that birthed this brave new world coincided with a rising conservative legal movement that advocates judicial restraint and a corporate lobby that has successfully pushed the idea that America is an excessively litigious society in dire need of “tort reform.” The result, lawyers and scholars say, is that thousands of cases that individuals once had a shot of winning can no longer even enter a courtroom, jeopardizing enforcement of laws spanning consumer and employee protection, civil rights and antitrust.

“Arbitration is being used to keep individuals from having any effective ability to enforce their rights,” says Margaret Moses, a professor at the University of Loyola School of Law. “You’ve completely undercut the law, cut it off at the knees.”

As with many of America’s legal traditions, our right to sue was born of a deep skepticism of concentrated power. Early Americans recognized that their ability to bring civil suits against politically connected wrongdoers would lessen their dependency on often-corrupt government officials. Following ancient British traditions, the Founders also enshrined the right to a jury trial in the Seventh Amendment, while preserving the principle, dating back to the 1267 Statute of Marlborough, that all trials be open to the public. Recognition of these rights reflected a fundamental awareness that laws created in a democratic society would be meaningless unless citizens also ensured their fair enforcement.

In the 19th century, Congress further embedded these principles by allowing individual plaintiffs to assume much of the enforcement role played by large regulatory bureaucracies in other industrializing countries. Practices like awarding triple damages to successful plaintiffs in antitrust suits, for example, encouraged private parties to take the lead at a time when “politically powerful institutions [were] able to intimidate and subvert public enforcement,” explains Paul Carrington, professor at Duke University School of Law. “Congress made the assessment that if it wanted the antitrust law enforced, it would have to rely primarily on private lawyers advising and representing the smaller businessmen whom the law was intended to protect.”

None of these principles were disturbed when, in 1925, Congress passed the Federal Arbitration Act, which recognized a limited use of arbitration as a way for businesses to speedily resolve disagreements with each other outside of courts. As corporate transactions had risen dramatically in the early 1900s, so had corporate disputes. Lobbied heavily by New York business interests, lawmakers recognized that freeing judges from resolving procedural skirmishes over contracts could benefit everyone. Some officials were wary that expanded use of arbitration might, as one put it, let “the powerful people … come in and take away the rights of the weaker ones.” But the business lobby assured them that arbitration would only be used between equally sophisticated companies, and only if both parties agreed.

And for many decades to come, arbitration worked as promised. But starting with a series of decisions in the 1980s, unlikely bedfellows on the Supreme Court would steer us down an entirely new path.

The slow creep began with a 1983 case, Moses H. Cone v. Mercury Construction. Though arbitration wasn’t the central issue at play, the Supreme Court used its opinion to offer a radically novel interpretation of the Federal Arbitration Act. Writing for a 6-3 majority, Justice William Brennan — a leader of the court’s liberal wing — declared that the FAA reflected a “federal policy favoring arbitration.” The idea that Congress had intended arbitration as preferable to courts rather than just as an alternative hadn’t been aired before. Still, Brennan’s language was clear and decisive — and future judges would lean heavily on it as they razed the walls that had kept arbitration in its place.

In a striking dissent, Justice Sandra Day O’Connor, a conservative, berated the majority for ignoring legislative history. “Today’s decision is unfaithful to congressional intent, unnecessary and … inexplicable,” she wrote. “Although arbitration is a worthy alternative to litigation, today’s exercise in judicial revisionism goes too far.”

It would soon go farther. In 1985, the Supreme Court heard Mitsubishi v. Soler Chrysler-Plymouth, a case in which a car dealer had sued the Japanese manufacturer for violating antitrust laws, and Mitsubishi had pushed to arbitrate. Recalling the Federal Arbitration Act, the car dealer pointed out that companies could only use arbitration to settle contracts they had written, not interpret laws Congress had passed, like the Sherman Antitrust Act. Stunningly, a five-justice majority — riding its recent wave — sided with Mitsubishi. Arbitrators could now rule on actual law — civil rights, labor protections, as well as antitrust — with no accountability or obligation to the public.

Three years, three decisions: the Supreme Court had drastically enlarged the scope of arbitration. The way the court split didn’t neatly map onto partisan ideology: liberal justices led the majority in two of the cases, dissented in others; while the conservative arm — which generally preferred to leave arbitration to the states — also jumped around.

Little evidence suggests that Brennan’s analysis followed congressional intent. “There was nothing in the legislative history that says Congress favored arbitration,” says Loyola Law School’s Margaret Moses. “The Supreme Court just stated it and then kept citing itself. It’s spurred a huge policy shift, with no basis in legislation.”

However baffling its reasoning, this drastic shift by the court followed a decade during which the conservative legal movement had rapidly gained intellectual clout and political power. The infamous 1971 “Powell memo” — a call to arms to corporations written by then corporate lawyer Lewis Powell, who would join the Supreme Court the following year — had galvanized the business community into organizing against liberal groups and consumer activists like Ralph Nader.

This court’s turn also accorded with a well-financed political campaign for “tort reform,” a conservative cause backed by groups such as the Federalist Society and the Olin Foundation. George H. W. Bush campaigned on tort reform in 1991, while Vice President Dan Quayle headed up the Council on Competitiveness, which held as a central aim eliminating class-action litigation against business. As one scholar of the movement put it, the prevailing belief at the time was that America suffered from “too much law, too many lawyers, courts that take on too much — and an excessive readiness to utilize all of them.”

And true enough, by some measures litigation had increased. In 1962, for example, US district courts conducted just under 6,000 civil trials; by 1981, they conducted more than 11,000. Public figures and the media tended to attribute all of this growth to “frivolous” lawsuits and zealous trial attorneys, but the rise also traced back to other factors, such as the civil rights wins of the 1960s, which meant that laws now protected a much larger segment of the population.

Nonetheless, it became received wisdom in many quarters that America had become an excessively litigious society. Over the 1990s books like The Litigation Explosion: What Happened When America Unleashed the Lawsuit proliferated, setting the culture in which the court continued to restrict lawsuits and promote arbitration. In 1998 the Chamber of Commerce founded the Institute for Legal Reform, committed to reducing “excessive and frivolous” lawsuits. The Federalist Society convened discussions such as “Is Overlawyering Taking Over Democracy?”

Against the ongoing meme of superfluous litigation, the courts further expanded the realms in which companies could compel arbitration. In the 1995 case Allied Bruce, the Supreme Court approved the use of arbitration clauses by companies in routine consumer contracts. In 2001 the court ruled against a group of Circuit City workers, holding that employers could use arbitration clauses in contracts with employees. In 2004 a court ruled that arbitration clauses were enforceable against illiterate consumers; another court ruled that they were enforceable even when a blind consumer had no knowledge of the agreement.

Yet the true watershed moment came in 2011, in the case of AT&T Mobility v. Concepcion. Vincent and Liza Concepcion had sued AT&T in California court, charging that the company had engaged in deceptive advertising by falsely claiming that their wireless plan included free cell phones — a practice that had shortchanged millions of consumers out of about $30 each. When they tried to litigate as a class, AT&T pointed to the fine print that prohibited consumers from banding together.

The Concepcions countered that these kinds of class-action bans violated California law as well as that of 20 other states. Moreover, scores of federal judges had forbidden this kind of class-action ban, on the grounds that people often had no practical way to make a claim unless they joined with other plaintiffs in sharing the cost. Allowing companies to wipe away this right in “take-it-or-leave-it” contracts for products like credit cards or phone service would effectively let corporations write themselves a free pass.

The district court and the Ninth Circuit Court of Appeals both supported the Concepcions, ruling that AT&T’s terms were “unconscionable,” a term of art historically used to describe contracts that so favored parties with superior bargaining power as to be unjust. When the case reached the Supreme Court, eight state attorneys general, as well as a legion of civil rights organizations, consumer advocates, employee rights groups and noted law professors, also weighed in, arguing that allowing these kinds of class bans would enable companies to evade entire realms of law. But the Supreme Court, in a 5-4 split, blessed AT&T’s contract, opening the door for companies to ban class actions routinely in their fine print.

At this point, there was one slender thread of protection left: class-action bans still weren’t enforceable if they eliminated the only way someone could bring a case. But in 2013, the Supreme Court gutted even this provision in a case pitting Italian Colors, a family restaurant in Oakland, California, against American Express. This time around, the same five-judge majority ruled that class-action bans in arbitration contracts were legal — even when they left citizens with no recourse at all.

Immediately, law firms around the country blasted out advisories to their corporate clients: Time to rewrite your contracts. The law firm Baker & McKenzie called it a “sea change,” comparing it to the “disruptive innovations from chemical photography to digital photography, from personal computers to smart phones and from snail mail to email,” and noting that if employers drafted the right language, “[e]mployment class action suits are no longer necessary.”

Schnader Harrison Segal & Lewis put it most succinctly: “For practical purposes the ‘effective vindication’ doctrine is a dead letter.” Courts no longer cared whether the fine print blocked individuals from claiming their statutory rights. Now, companies would be foolish not to adopt this innovative clause.

So corporations have taken heed, quietly folding these new terms into what are often “take-it-or-leave-it” agreements based on pure market power — realizing the exact scenario Congress feared 90 years ago. “These terms get foisted on us,” said Pamela Gilbert, partner at Cune Gilbert & LaDuca and consumer rights advocate. “They’re not really ‘contracts’ at all.”

Stories documenting Americans’ fabled zeal for lawsuits are legion. There’s the one about the old lady who sued McDonald’s over a cup of coffee that was too hot, or about the guy who took Anheuser-Busch to court because his six-pack failed to deliver visions of beautiful women clad in bikinis on a balmy beach.

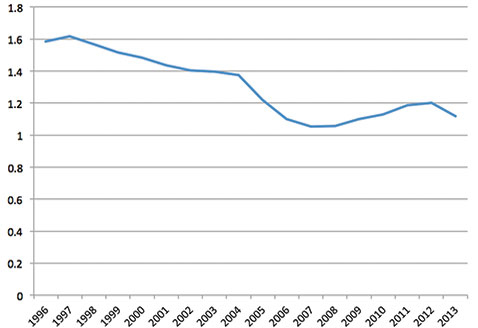

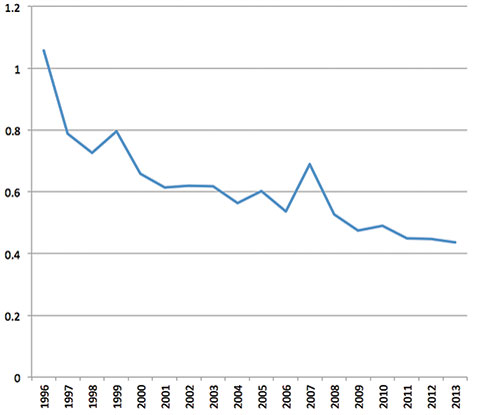

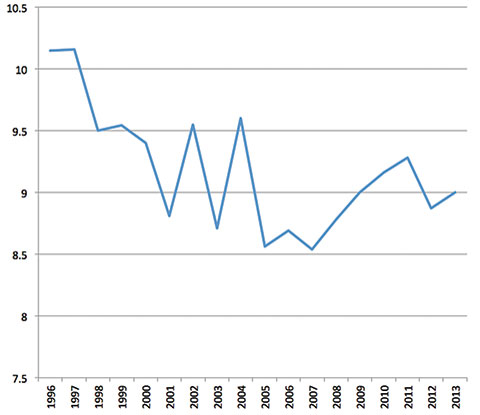

Yet while anecdotes about frivolous litigation have risen to the rank of cliche, the number of lawsuits brought by Americans has actually been falling for decades. The latest data shows that, on a per capita basis, the total number of cases commenced in US district courts fell by 11 percent between 1996 and 2013, personal injury cases by 58 percent and civil rights cases by 29 percent. At the state level, the number of tort cases filed per capita between 2001 and 2010 dropped by 23 percent in Texas district courts, by 29 percent in California superior courts and by 30 percent in New York supreme and county courts.

It is still too early to quantify the fallout since the Supreme Court’s latest decisions. But anecdotes capture many instances in which companies have taken advantage of the rulings to thwart suits. In 2011, for example, students won a $40 million settlement by filing actions against the Career Education Corporation (CEC), owner of for-profit culinary schools. According to students, the CEC misrepresented its degree and deceived the students into taking on crippling debt. Since then, the CEC has added a binding arbitration clause and class-action ban in its contract. An attorney who represented students in one of the earlier cases says he will no longer bring suits for similarly situated students, as the CEC’s new clause is effectively impossible to overcome.

Julie Strandlie, legislative and public policy director of the National Employment Lawyers Association, says that the organization now regularly sees employees forced into arbitration on matters spanning alleged wage theft, discrimination and unlawful termination. “These terms are slipped into contracts between parties of unequal bargaining power, they force people to give up their rights to get or to keep a job,” she said.

Consumer and employee advocates note that arbitration can be a fair and speedy alternative to courts, especially when tight budgets have slashed judiciary funds and shuttered courtrooms in places like California, which has closed 51 courthouses and 205 courtrooms since 2008. If individuals stand to gain from arbitration, though, critics note, they will readily sign up. “Nobody is against alternative mechanisms to resolve disputes — just those that are unknowingly and involuntarily forced on us,” says Gilbert.

If the only way businesses can get individuals to arbitrate is by imposing it on them, it seems clear who’s reaping the gains. “The whole notion of mandatory arbitration clauses is designed to disenfranchise consumers and citizens through language that nobody reads,” says Bill Brauch, director of the consumer protection division at the Iowa attorney general’s office.

Graph 1: Civil Rights Cases Commenced in US District Courts Per 10,000 Americans

When coupled with class-action bans, binding arbitration can wipe out private cases entirely. Experts say that this could become more common in the realm of antitrust, where the cost of bringing a case is usually far beyond the reach of any single individual or small business. So learned Alan Carlson, the plaintiff in the 2013 landmark American Express v. Italian Colors case. The owner of an Italian family restaurant, Carlson charged that American Express was abusing its market power by forcing him and other business owners to accept new cards with much higher rates. But when the Supreme Court denied Carlson the right to join with other small businesses in bringing an antitrust suit, it effectively prevented him and everyone else affected from pursing any recourse at all.

Because antitrust cases today require extensive economic analysis, bringing such a case would cost anywhere from $200,000 to $1 million in fees, while the highest judgment any individual might win would be around $40,000. Even if he’d been able to scrounge up the money somehow, “no attorney would take the case because it made no economic sense,” Carlson says. “The bully is holding all the cards.

Bert Foer, president of the American Antitrust Institute, says that many sound antitrust cases no longer get heard, by a judge or an arbitrator, because of class-action bans. “The American Express decision cuts back the quantity of antitrust cases that can be brought [by private parties],” he says. “It takes away citizens’ rights.”

In a fiery dissent in the American Express case, Justice Elena Kagan honed in on how the same muscle that empowers a company to impose a monopolistic scheme also enables it to force its customers into signing away their right to sue or engage in collective action. The court’s decision means that a “monopolist gets to use its monopoly power to insist on a contract effectively depriving its victims of all legal recourse,” she wrote. The court’s answer, according to Kagan? “Too darn bad.”

Countering these stories are studies purporting to show that compelling consumers and employers into arbitration actually works in their interests. One by an attorney at the National Arbitration Forum claims that consumers prevail in 61 percent of the arbitrations they initiate. Another funded by the US Chamber Institute for Legal Reform surveyed empirical research to conclude that individuals achieve “superior” results in arbitration compared to courts.

Graph 2: Personal Injury Cases Commenced in US District Courts Per 10,000 Americans

Groups like Public Citizen and Public Justice point out, however, that many of these studies cherry-pick data or offer up misleading analyses (a charge that the authors of these studies wage right back at them). A 2007 report by Public Citizen, for example, reviewed data from one of the big arbitrator companies and found that arbitrators ruled against consumers 94 percent of the time. In 2008 it also reviewed the Chamber’s study to reveal how the underlying data actually showed that individuals generally win fewer times and receive less money in arbitration than in court. A recent study by Mark Gough, a PhD candidate at the Industrial Labor Relations School at Cornell University, focused on employee-employer disputes and documented the same trend: arbitration decreases the odds of an employee win by 59 percent, and decreases the amount awarded by 35 percent. For employees, “[o]utcomes in arbitration are starkly inferior to outcomes in litigation,” Gough concluded.

James Baker, a partner at Baker & McKenzie who specializes in defending employers against suits over pension plans, agrees. “There’s no question that [arbitration] favors the company’s interest over employees,” said Baker, adding that he sees fewer class-action cases filed in the wake of the Concepcion and Italian Colors decisions.

Bear in mind that all these studies on the outcomes of arbitration must either draw from small sample sizes or depend on the big arbitrators — like the American Arbitration Association and the Judicial Arbitration and Mediation Services — to voluntarily share data. No public body tracks even the number of arbitration claims filed. In 2002 California enacted legislation requiring arbitration companies to publish basic data on the consumer arbitrations they administer. A state compliance review last year found that as of December 2013, only eight of the 25 private arbitration companies in California posted any of the required information at all.

Graph 3: Total Civil Cases Commenced in US District Courts Per 10,000 Americans

Critics also point out that assessing arbitration based on the outcomes of cases is misleading because it overlooks all the cases that arbitration may suppress. Studies have found that a tiny fraction of the population actually chooses to arbitrate. Last December the Consumer Financial Protection Bureau released the preliminary results of its study on the use of arbitration clauses in credit cards, checking accounts and pre-paid cards. It found that between 2010 and 2012, out of 80 million American cardholders, only 1,033 consumers arbitrated with companies — or less than 0.001 percent. It’s the same picture across industries: between 2003 and 2007, only 170 of AT&T’s 70 million customers filed an arbitration claim, or 0.0002 percent.

Consider, too, how the incentives on an arbitrator differ from those on judges. Judges are paid from public taxes; arbitrators are paid by whoever is retaining them. Sometimes both parties split the cost equally; often companies will offer to cover the entire thing. Either way, critics say the chance of repeat business can give arbitrators an incentive to rule in a company’s favor.

In 2009, the National Arbitration Forum, the largest administrator of credit card and consumer collections arbitrations in the country at the time, was found to be persuading companies to insert arbitration clauses in contracts and then settling on itself to arbitrate them — in other words, peddling the very organizations whose actions it would later judge. Similarly, in cases where there is a dispute over whether a contract requires arbitration, the courts have ruled that arbitration companies themselves should decide whether or not they get the business.

Arbitrators are also unlike judges in that they don’t have to follow legal precedent, they’re not bound by the same rules of evidence as courts, and — in some states — they don’t have to be lawyers at all. “Arbitrators are much less demanding in the evidence they require,” said Allan King, a partner at Littler Mendelson with extensive experience defending companies against class-action suits.

Still, courts now give great deference to whatever arbitrators decide. In one Seventh Circuit case, the court said it would uphold the arbitrator’s decision if his interpretation of a contract were “incorrect or even wacky.” Only if an arbitrator shows “manifest disregard” for the law can the decision be overturned.

The greatest damage here isn’t to us as individuals. “Mandatory arbitration is a basic threat to our democracy,” says Deepak Gupta, who argued the 2011 AT&T case before the Supreme Court. “This isn’t about us all getting our $30 checks when a company has ripped us off. It’s about laws that Congress passes being enforceable. The Supreme Court is allowing corporations to overturn law made by people we elect.”

Diverting all cases to arbitration also promotes a culture of impunity, enabling wrongdoers to more easily continue their wrongdoing. And when the threat of litigation is strong, it discourages corporations from engaging in misconduct in the first place. By contrast, says Ed Mierzwinski, consumer program director at the US Public Interest Research Group, “[t]he use of forced arbitration clauses has essentially immunized corporate America from any responsibility for its actions.” In the same way that the Justice Department’s decision to fine banks rather than prosecute executives encourages financial institutions to build in penalties as a cost of business, arbitration incentivizes companies to write down settlement awards as a routine cost, while perpetuating harms at large.

Public officials say they cannot fill the void created by the drop-off in private suits. “We cannot bring every case. No state has ever had or will have enough resources to supplant the role that private-action attorneys have,” said Brauch from the Iowa attorney general’s office. The proliferation of binding arbitration means that “state laws are basically being gutted,” he said.

By enabling companies to keep their wrongdoing secret, arbitration chokes off information vital to the public. Consider the long course of anti-tobacco company litigation and how it ultimately affected policy. Individual plaintiffs filed over 800 suits against tobacco companies between 1954 and 1994, bringing reams of internal documents into the public domain. Although the companies overwhelmingly prevailed in the private actions, the information the suits unsealed eventually emboldened 46 states to file their own cases, culminating in a $206 billion settlement that also imposed sweeping changes across the industry.

If people harmed by tobacco companies had been forced to arbitrate their cases, there’s a good chance the public today wouldn’t know how tobacco companies maneuvered to make cigarettes more addictive and to hide their lethal health effects. More recently, details on how Bank of America, JP Morgan and other financial institutions wrongfully seized people’s homes in the wake of the subprime mortgage bust also emerged out of a case brought by a private lawyer.

What will become of all this depends on whether Congress chooses to act. Last year Minnesota Senator Al Franken and Georgia Representative Hank Johnson reintroduced the Arbitration Fairness Act, which would prohibit mandatory arbitration in employment, consumer, civil rights and antitrust disputes. Lawmakers have been floating a version of the bill for seven years. Even its supporters admit that — given the level of opposition from the Chamber of Commerce and other business interests — it is unlikely to pass anytime soon.

If Congress doesn’t act, though, core legislation that Americans have won through decades-long fights for a more just society — including minimum-wage laws, bans on racial discrimination, and checks on monopolies — is greatly imperiled. The outcome will go to the heart of whether laws function as a check on corporate power in an era where the weight and reach of that power have grown immensely. Unless we seize back our right to courts, these other rights will exist only in name.