A sign for Wall Street is displayed on the side of building near the New York Stock Exchange, Monday, March 4, 2013. (AP Photo/Mark Lennihan)

Few books have been met with as much anticipation at Thomas Piketty’s Capital in the 21st Century. A reviewer in the Journal of Economic Thinking declares it “one of the watershed books in economic thinking.”

Piketty, an economist at the Paris School of Economics, is well known for his work on inequality — much of what we know about American inequality is based on a database he developed with Emmanuel Saez of UC Berkeley.

The book has been available in French for several months, and the English translation, by Arthur Goldhammer, is due out in March. Its release is expected to set off a firestorm in our economic discourse.

Thomas Edsall previewed the book in Tuesday’s New York Times.

Edsall:

Thomas Piketty’s new book, “Capital in the Twenty-First Century,”described by one French newspaper as a “a political and theoretical bulldozer,” defies left and right orthodoxy by arguing that worsening inequality is an inevitable outcome of free market capitalism.

Piketty, a professor at the Paris School of Economics, does not stop there. He contends that capitalism’s inherent dynamic propels powerful forces that threaten democratic societies.

Capitalism, according to Piketty, confronts both modern and modernizing countries with a dilemma: entrepreneurs become increasingly dominant over those who own only their own labor. In Piketty’s view, while emerging economies can defeat this logic in the near term, in the long run, “when pay setters set their own pay, there’s no limit,” unless “confiscatory tax rates” are imposed.

Piketty’s book… suggests that traditional liberal government policies on spending, taxation and regulation will fail to diminish inequality. Piketty has also delivered and posted a series of lectures in French and English outlining his argument.

Conservative readers will find that Piketty’s book disputes the view that the free market, liberated from the distorting effects of government intervention, “distributes,” as Milton Friedman famously put it, “the fruits of economic progress among all people. That’s the secret of the enormous improvements in the conditions of the working person over the past two centuries.”

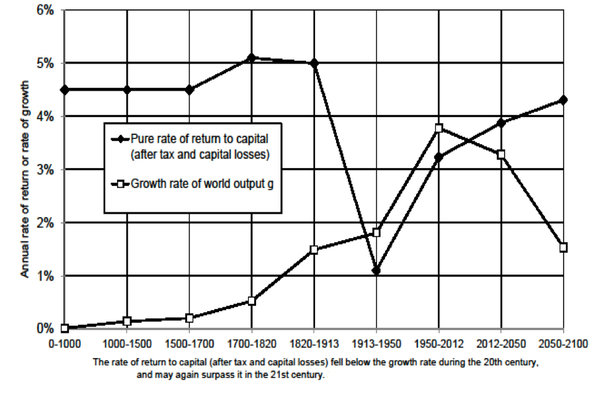

Piketty proposes instead that the rise in inequality reflects markets working precisely as they should: “This has nothing to do with a market imperfection: the more perfect the capital market, the higher” the rate of return on capital is in comparison to the rate of growth of the economy. The higher this ratio is, the greater inequality is.