This post first appeared in The Nation.

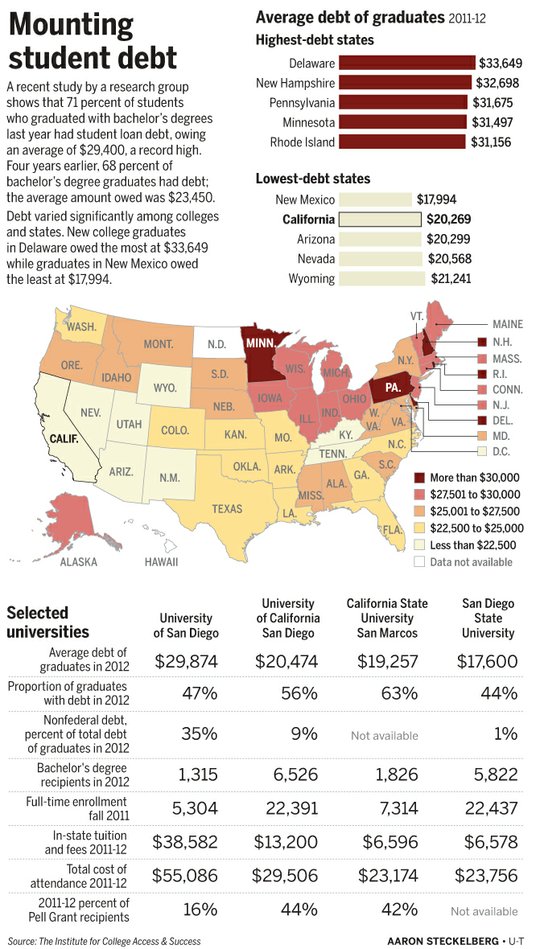

The Institute for College Access & Success, an independent nonprofit organization based in Oakland, California recently released its eighth annual report on average student loan debt in the US, and its findings are dire. College graduates who borrowed for bachelor’s degrees granted in 2012 have an average student loan debt of $29,400, the highest average student loan debt ever on record.

Overall, 70 percent of college seniors graduated in 2012 with debt.

“The graduates of 2012 left school and entered repayment at a time of high unemployment,” said Debbie Cochrane, research director at the institute. “In many ways, these graduates were hit from both sides.”

“They went to college during a recession when their family’s ability to pay for college was likely reduced. Now they are graduating from college and may be experiencing substantial challenges getting a job to repay the loans.”

Lynn O’Shaughnessy, an expert on college issues who lives in La Mesa, says the trend isn’t likely to reverse itself anytime soon because the price of higher education continues to rise while incomes remain flat.

“College costs have always gone up higher than inflation, but the problem we face now is that family incomes are stagnant and they can’t afford it anymore, if they ever did,” said O’Shaughnessy, author of the book The College Solution and a blog of the same name. “It used to be much more affordable.”

Students in certain states are hit particularly hard. For example, average debt is higher for graduates from Pennsylvania ($31,675). Seventy percent of graduates from Pennsylvania public and nonprofit colleges have student loan debt, compared to 41 percent of students graduating from Nevada colleges. The average student debt in New Mexico is just under $18,000.

Mike Morrill executive director for Keystone Progress, an activist network, explains the long-term effects: “Even if you are able to get a good job it means that if you’re graduating with $30,000 or more in debt, that means it’s going to be a long time before you get rid of that debt. It makes it harder for you to buy a house harder to start a business.”

The Times Herald reports that college expenses in Pennsylvania have become outrageously high over the past decade, fueled in part by the “easy money” of student loans and government financial aid. Schools maintain extremely high principals (the cost of tuition) and offset the costs to students, who are expected to take out loans that could potentially permanently bury them in debt.

And student debt, like subprime loans, is a huge moneymaking scheme from which the government is making a pretty penny. Rolling Stone’s Matt Taibbi reports the federal government is poised to make $185 billion over the next 10 years on student loans.

Before Christmas, senators Elizabeth Warren (D-MA), Jack Reed (D-RI) and Dick Durbin (D-IL) released a slate of proposed reforms aimed at lowering student debt, including a student borrower’s bill of rights that would put more emphasis on getting servicers to offer students affordable repayment plans, and a provision that would require schools with lots of struggling borrowers to compensate the government for loan repayment losses.

Businessweek reports the penalty proposed in the Protect Student Borrowers Act of 2013 would affect schools at which at least a quarter of students take out loans, a threshold that would include most institutions. Community colleges would be exempt, along with historically black institutions, according to Inside Higher Ed.

|

Allison Kilkenny is the co-host of the progressive political podcast Citizen Radio and independent journalist who blogs at allisonkilkenny.com. Her work has appeared in The American Prospect, the LA Times, In These Times, Truthout and the award-winning grassroots NYC newspaper the Indypendent. |