In this weekend’s Moyers & Company, Rolling Stone reporter Matt Taibbi and Naked Capitalism blogger Yves Smith explain how the toxic credit swaps and corruption that went on in Jefferson County, Alabama, resulted in the biggest municipal bankruptcy in American history.

Commuters enter and exit a train at the MTA Red Line Hollywood/Western station in Los Angeles. (AP Photo/Reed Saxon,File)

Trouble is, they can’t. The way these deals were structured, borrowers can’t refinance at lower interest rates without paying huge termination fees. Morgenson reports that New York State recently paid $243 million dollars to get out of some swaps. Detroit was planning to spend $288 million on swaps earlier this month, according to Bloomberg News. So most municipalities are stuck with bad deals that will not likely improve anytime soon.

Morgenson explains:

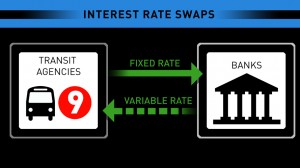

Behind all of this is — you guessed it — derivatives. Bankers have embedded interest-rate swaps in many long-term municipal bonds. Back when, they persuaded states and others to issue bonds and simultaneously enter into swaps. In these arrangements, the banks agreed to make variable-rate payments to the issuers — and the issuers, in turn, agreed to make fixed-rate payments to the banks involved.

These swaps were supposed to save the public some money. And, for a while, they did. Then the financial crisis hit — and rates went south and stayed there. Now issuers are paying bond holders above-market rates as high as 6 percent. In return, they are collecting a pittance from banks — typically 0.5 percent to 1 percent.

One striking example of how these swaps are crippling state and local finances — already stretched thin by lower tax receipts and federal funding cuts — is in mass transit. A new study done by the ReFund Transit Coalition, a pro-public transportation group, reports that the transit agencies they surveyed are being “gouged” by Wall Street banks for more than half a billion dollars each year.

DC StreetsBlog Angie Schmitt reminds readers that these toxic swap losses come on top of “major funding crises and unprecedented demand” for public transportation systems across the country. Due to the recession and the stalled federal transportation bill — the last one expired 3 years ago and the current extension expires on June 30 — nearly 80 percent of transit agencies raised fares or cut services in the past two years.

Some banks have renegotiated swaps — the ReFund report says Detroit and San Francisco have been successful — but it’s more likely that the majority of cash-strapped transit systems will continue to pass along the cost of toxic swaps to riders in the form of fare hikes and service cuts. In this recession, that can be particularly hard on students, the elderly and the disabled who may not have any other means of transportation.

As Morgenson concludes in her column:

“You know the score. Once again, it’s Wall Street 1, Main Street 0.”