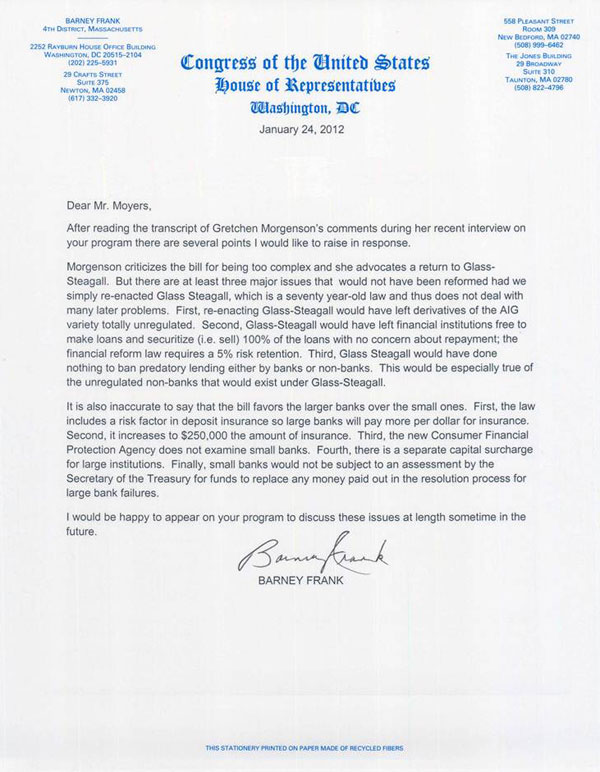

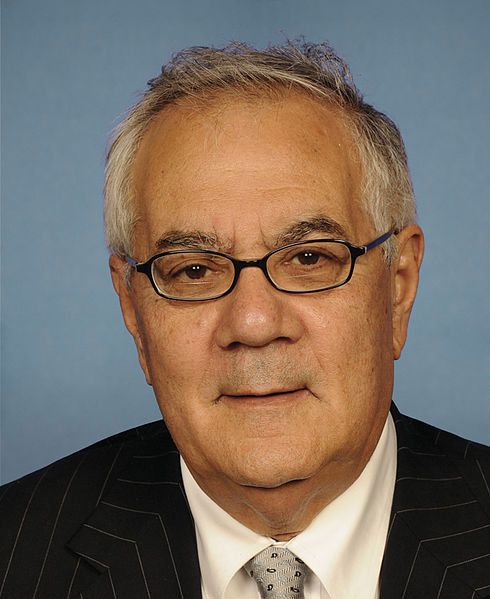

Rep. Barney Frank (D-MA), senior Democrat on the House Financial Services Committee and co-author of the Dodd-Frank bill, took issue with parts of our interview with Gretchen Morgenson, financial columnist for The New York Times and co-author of Reckless Endangerment: How Outsized Ambition, Greed, and Corruption Led to Economic Armageddon. Below is Rep. Frank’s letter, along with a response from Ms. Morgenson.

Rep. Barney Frank (D-MA), senior Democrat on the House Financial Services Committee and co-author of the Dodd-Frank bill, took issue with parts of our interview with Gretchen Morgenson, financial columnist for The New York Times and co-author of Reckless Endangerment: How Outsized Ambition, Greed, and Corruption Led to Economic Armageddon. Below is Rep. Frank’s letter, along with a response from Ms. Morgenson.

It is only natural that Mr. Frank would want to defend the legislation bearing his name. But the small examples he uses as proof that the law was tough on big banks are far outweighed by other aspects of the law that favor big banks. These include the resolution authority under Dodd-Frank, which puts large institutions through a special unwinding process when they get into trouble. Small banks, by contrast, will be allowed simply to fail. Before a large institution can be placed into resolution, a throng of financial regulators, including the Treasury Secretary, must sign off on that decision. This sets up the potential for special treatment as far as large, politically well-connected banks are concerned; who couldn’t foresee a powerful bank being saved, not resolved, largely because it has friends in high places in Washington?

It is only natural that Mr. Frank would want to defend the legislation bearing his name. But the small examples he uses as proof that the law was tough on big banks are far outweighed by other aspects of the law that favor big banks. These include the resolution authority under Dodd-Frank, which puts large institutions through a special unwinding process when they get into trouble. Small banks, by contrast, will be allowed simply to fail. Before a large institution can be placed into resolution, a throng of financial regulators, including the Treasury Secretary, must sign off on that decision. This sets up the potential for special treatment as far as large, politically well-connected banks are concerned; who couldn’t foresee a powerful bank being saved, not resolved, largely because it has friends in high places in Washington?

This special resolution authority is not only unfair, it sends a pernicious signal to the market about large and intertwined institutions. Subject as they will be to a newly codified resolution authority, these institutions and their lenders can expect to be rescued if they get into trouble. This perception delivers lucrative advantages to these institutions; the main one is lower borrowing costs, the result of investors’ assumptions that the giants are less risky because they will be in line for government assistance if they totter. Think Fannie Mae and Freddie Mac, both of which assured taxpayers throughout the 1990s and early 2000s that they would never cost us a dime.

Dodd-Frank also allows even the largest banks to buy troubled institutions in times of crisis, thereby letting them grow in size and potential peril. A section of the law lets large institutions, even those subject to limits on concentration of assets, to buy failing banks if regulators approve the deals. I cannot imagine a regulator saying no to such a deal when the next crisis hits.

According to a Bloomberg analysis, financial institutions have grown only larger since the financial crisis. The top 10 banks in the U.S. held 77 percent of the nation’s bank assets, compared with 55 percent in 2002. Bloomberg projects that too-big-to-fail institutions will increase by 40 percent over the next dozen years.

In essence, Dodd-Frank entrenched too-big-to-fail institutions into the system rather than eliminating them and the risks they pose. Tom Hoenig, the former president of the Federal Reserve Bank of Kansas City (and someone willing to speak truth to power) has said as much on Dodd-Frank. Here is an excellent Q&A with American Banker where he outlines his concerns and his opinion that the law was a missed opportunity regarding too-big-to-fail institutions.