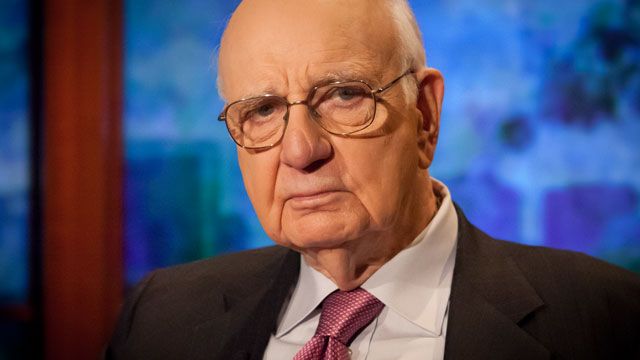

Paul Volcker was Chairman of the Federal Reserve in 1979, and became well-known for raising interest rates and imposing tight restrictions on credit in an effort to stabilize the economy. When unemployment rates reached nearly 11 percent, some called for Volcker’s resignation. Senator Howard Baker called for the Fed to “get its boot off the neck of the economy.” But by the mid-1980s, Volcker’s tough policies had helped to stabilize prices. Volcker left the fed in 1987.

Prior to his time in Washington, Volcker was a financial economist and later a vice president at Chase Manhattan Bank. He served in the Treasury Department during the Johnson and Nixon administrations.

In 2009, President Obama named Volcker as head of the President’s Economic Recovery Advisory Board (PERAB). The board’s purpose is to advise the President on issues stemming from the 2008 financial meltdown. In that role, Volcker was far more critical of the financial industry than most other members of the administration, which included Treasury Secretary Timothy Geithner and Larry Summers, the director of the National Economic Council.

Volcker stepped down from his role at PERAB in 2011, but he continues to be an outspoken critic of Washington’s reluctance to rein in the country’s financial giants. Before leaving the administration, he proposed the Volcker Rule, a version of which is part of the Dodd-Frank Wall Street Reform and Consumer Protection Act. The rule, which is set to go into effect in July 2012, would prohibit banks from engaging in speculative trading with deposits that are federally insured. The rule has been compared to the Glass-Steagall Act of 1933, a law whose repeal in 1999 has been partially blamed by economists for the 2008 financial crisis.