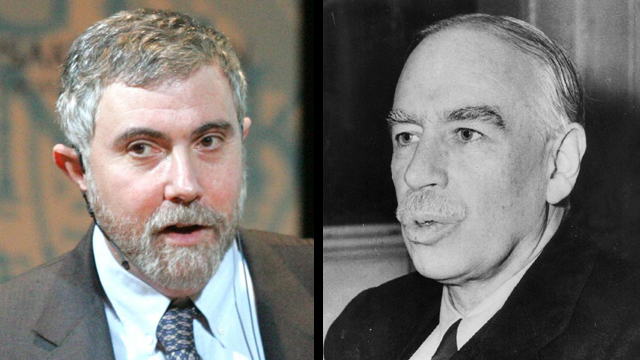

Paul Krugman has been called “today’s leading interpreter of John Maynard Keynes,” the British economist whose ideas created a shift in thinking about macroeconomics during the 1930s, when the US was struggling to recover from the Great Depression. Keynesians tend to favor public sector spending — a tactic that suceeded when Franklin D. Roosevelt’s administration prepared for war in Europe — to help economies through difficult times.

In fact, Krugman — who was recently interviewed on Moyers & Company — even introduced Macmillan’s recent edition of Keynes’ seminal work, The General Theory of Employment, Interest and Money calling it “the most important book in the history of economics.”

|

We’ve pulled together some of Krugman’s writings for the New York Times on how he would apply Keynesian economics to our modern-day economic crisis.

Bleeding Europe — 12/11/2012

“[T]he economics of austerity have played out exactly according to script — the Keynesian script, that is, not the austerian script. Again and again, “responsible” technocrats induce their nations to accept the bitter austerity medicine; again and again, they fail to deliver results. The latest case in point is Italy…”

The iPhone Stimulus — 9/13/2012

“[D]epressions do end, eventually, even without government policies to get the economy out of this trap. Why? Long ago, John Maynard Keynes suggested that the answer was “use, decay, and obsolescence”: even in a depressed economy, at some point businesses will start replacing equipment, either because the stuff they have has worn out, or because much better stuff has come along; and, once they start doing that, the economy perks up. Sure enough, that’s what Apple is doing.”

“[Y]ou should be a Keynesian, too. The experience of the past few years — above all, the spectacular failure of austerity policies in Europe — has been a dramatic demonstration of Keynes’s basic point: slashing spending in a depressed economy depresses that economy further.”

Keynes Was Right — 12/29/2011

“‘The boom, not the slump, is the right time for austerity at the Treasury.’ So declared John Maynard Keynes in 1937, even as FDR was about to prove him right by trying to balance the budget too soon, sending the United States economy — which had been steadily recovering up to that point — into a severe recession. […]Unfortunately, in late 2010 and early 2011, politicians and policy makers in much of the Western world believed that they knew better, that we should focus on deficits, not jobs, even though our economies had barely begun to recover from the slump that followed the financial crisis.”

Keynesophobia — 12/19/2011

“It is indeed frustrating that after three years in which Keynesian predictions have been spectacularly correct, pundits insist on reading the evidence as a rejection of Keynes.”