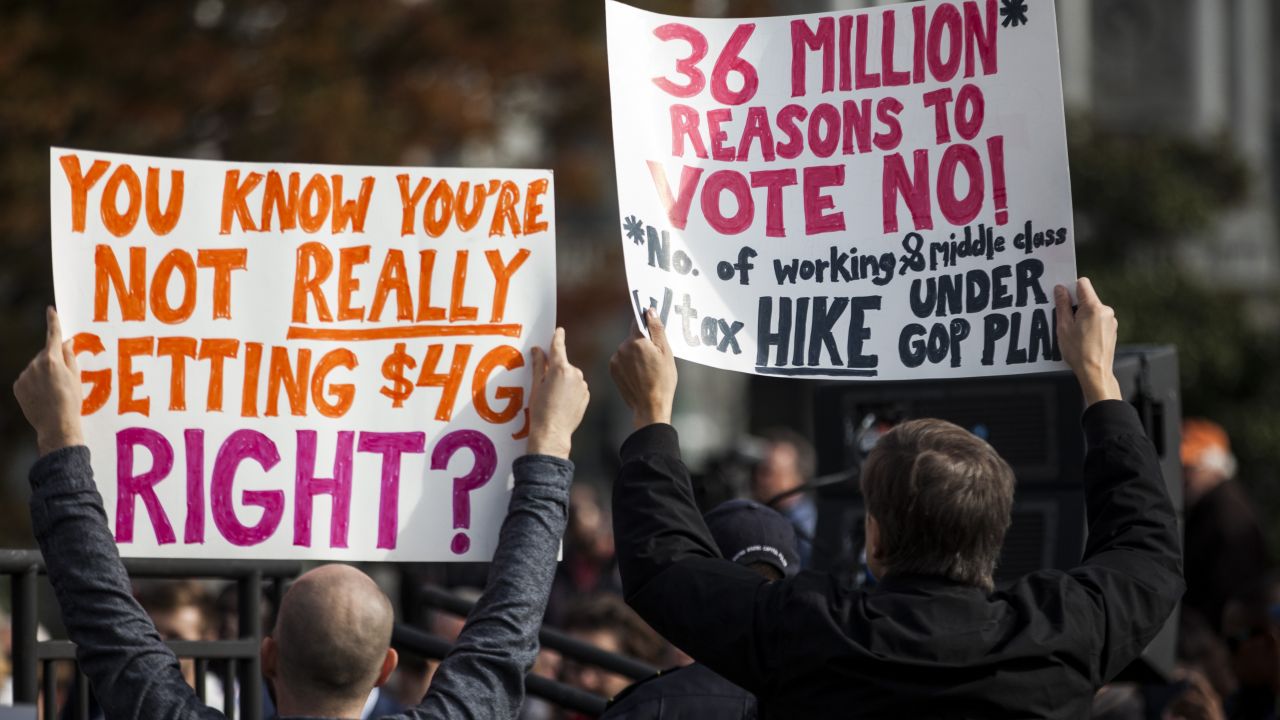

Demonstrators hold signs during a rally against the GOP tax plan in Washington, DC, on Nov. 15, 2017. (Photo by Zach Gibson/Bloomberg via Getty Images)

OK, you know the scenario by now. Congressional Republicans propose — surprise! — tax cuts. The vast bulk of these cuts go to the very wealthiest Americans and to corporations, which are headed by these wealthy Americans and which give them dividends that are taxed at lower rates. Meanwhile, ordinary working Americans, and by “working” I include professionals who earn a wage or salary, get modest cuts or no cuts at all.

The Republicans hail their cuts as a way to stimulate the economy, because in their infinite charitableness, rich people will now hire poorer ones with all the dough they save. In fact, they say, this is the only way to stimulate the economy. But even if the economy is roaring, the cuts are necessary to continue stoking it. Tax cuts, then, are the policy for all seasons — in truth, the panacea for all seasons.

And then Republicans pass the tax cuts, and a good many Americans — even those blue-collar Joes — cheer, because after all, they may get a few pennies on the dollar.

There is a name for this: “playing us for suckers.” And Americans seem to fall for it every single time. Who doesn’t want tax cuts? They are the opiate of politics.

But a funny thing happened on the way to the new GOP cuts, billed fallaciously as “tax reform.” This time, the public hasn’t seemed to swallow the bait — at least not hook, line and sinker. Polls are all over the place, from those showing outright opposition to those showing decreasing support the more the public learns about the bill.

No, this isn’t exactly a political earthquake, but it isn’t nothing. Having been played for suckers for decades, Americans may be wising up. That doesn’t mean, of course, that the tax-cut package won’t pass. The Republicans and their fearless leader, Donald Trump, are desperate — really, really desperate. They need a victory, whether the American people oppose the policy or not. Any sort of victory will do.

Besides, Republican benefactors — those wealthy Americans who are always trying to redistribute wealth from us to them and whose greed can never be sated — are demanding the cuts. Otherwise, they say, they won’t fund the GOP. So the incentives are huge, and they are entirely political.

However shameless, in the past, this tax cut adage that you can fool all of the people all of the time has worked for several reasons. First, taxes are just so damn complicated. They have so many moving parts, so many contingencies, that it’s difficult to develop a powerful counter-narrative to the GOP narrative that if your taxes go down, jobs will bloom — a proven fallacy, by the way. In fact, at a Wall Street Journal conference of CEOs this week with Trump’s top economic adviser Gary Cohn, only a few hands went up when attendees were asked if they intended to invest their new windfall. So much for trickle down.

Second, because tax policy is complicated, the media seem helpless to explain it. When the media did their yeoman work on the Obamacare repeal earlier this year, helping to rally the public against it, they had a single, simple Congressional Budget Office number to dramatically demonstrate its effects. And they were not loath to show us the casualties — parents with a disabled child, sons and daughters with ill parents, cancer patients, people suffering from chronic conditions. By the time the Senate held its first repeal vote, only 17 percent of Americans supported the effort.

The challenge of tax reform is much greater, and the media haven’t risen to it. There is no single data point that captures its effects. There is no group of individual casualties that illustrate what would happen if they pass. But rather than provide explanations, the media have left the field to the Republicans. Just the words “tax cuts” are pretty potent stuff. It would take a lot for the media to survey the consequences and push back, and they don’t seem to be up to it. Nor does it help that Republicans are trying to rush it through before people can see the details.

And then there is that one impulse on which Republicans have always relied. So long as ordinary Americans get something, they don’t seem to care very much that the rich get nearly everything else. Maybe it’s fatigue. Or maybe it’s just that if you get your little piece of the action, you are essentially bought off.

Finally, there is the larger issue. Republicans have managed to convince Americans — not that it took much convincing — that taxes are a form of government theft rather than a way to pay for services and what economists call “diseconomies,” or things that would not be paid for by the market, like defense or assistance to the needy. In effect, Republicans have delegitimized taxes in order to delegitimize government.

What’s more, they have convinced a good many Americans that our tax structure, rather than aiding the rich and hurting the poor and middle class, actually takes from that hard-working middle class and gives to the allegedly undeserving poor — another blatant fallacy.

Forty years of brainwashing can do that. Pitting Americans against one another didn’t begin with Trump. It has been the long-term Republican strategy at least since Reagan.

So why are Americans seemingly more skeptical this time? For one, I think they realize they were played in the past. The gigantic Bush tax cuts didn’t bring more jobs and higher wages. Remember the Great Recession? Second, as polling numbers on the GOP’s favorability indicate, it may have finally dawned on Americans that Republicans don’t have their best interests at heart. That was one of the major consequences of the attempted Obamacare repeal. It revealed that there was no reason, save for ideological zealotry and a desire to deliver even more largesse to the rich, for Republicans to destroy health insurance for those who couldn’t otherwise get it.

You might also give Trump credit here. He hasn’t contributed to the public weal in any way I can think of, except perhaps for this: He has made Americans far more suspicious of Republican motives.

Finally, there is the possibility that Republicans may have at long last overplayed their hand. The art of politics is getting as much as you can get without being egregious about it. Well, Republicans have been egregious, so much so that even some of the wealthiest Americans oppose the plan.

Republicans have roused health care givers who will lose deductions, graduate students who will have to pay taxes on scholarships, people in blue states who won’t be able to deduct state and local taxes, professionals who have to pay higher taxes than those who get their money passively through investments. Private universities, as punishment for their liberal tilt, will have to pay taxes on endowments. And here’s the pièce de résistance: anyone who benefits from Obamacare will be hurt, because Republicans are hoping to pay for their tax cuts for the rich by repealing the individual mandate, even though that battle already has been fought several times.

Incidentally, individual tax cuts will expire while corporate cuts won’t. So all in all, this is a giant screw-over, and it comes at a time when economic inequality has finally entered the grass-roots political discussion.

Republicans’ naked attempts to give a humongous boondoggle to their wealthy puppet masters at the expense of just about everyone else should halt this train, but it continues to grind forward. Just when you think the GOP may have blown it, they seem to double down.

I am not optimistic, but the fact that Americans seem so ambivalent about tax cuts may nevertheless be, as I said, a harbinger of a better, smarter politics from a more enlightened citizenry. I like to think that you can rob the middle class to give to the rich just so long before they figure out what’s happening. Perhaps now they do.