Around this time last year, the story of a Canton, Ohio, Wal-Mart running a food drive to help its impoverished “associates” get through the holidays became the symbol of how hard it is to make ends meet working for the country’s largest private employer.

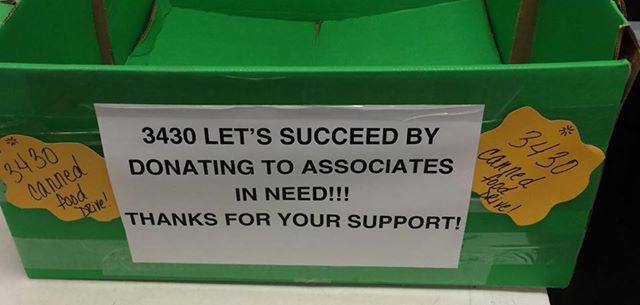

Today, Making Change at Wal-Mart, a labor-backed group working to expose the mega-retailer’s exploitative labor practices, posted this on its Facebook page:

The text accompanying the picture reads in part:

Despite a massive backlash last year when news broke that Walmart was holding an in-store canned food drive asking workers to donate to one another to keep from going hungry, Walmart hasn’t changed its ways. An Oklahoma Walmart is running another food drive this year!

A spokeperson for the group told BillMoyers.com via email that the picture was taken recently by an employee who wished to remain anonymous. The location of the food bin was identified as the Wal-Mart “superstore” designated by the company as #3430 and located on NE 23rd Road in Oklahoma City, Oklahoma.

Meanwhile, as Wal-Mart’s low-wage workers are helping each other out with food donations, the Waltons themselves, whose combined wealth is equal to that of the bottom 42 percent of American households, “have contributed almost none of their personal fortune” to their family’s charitable foundation, according to an analysis of 23 years of tax returns conducted earlier this year by Making Change at Wal-Mart.

According to the report, the Waltons use their family’s foundation primarily to avoid paying their fair share of taxes.

Tax avoidance appears to be a family passion. A study released today by Americans for Tax Fairness finds that over the past five years, Wal-Mart, Inc., has used a variety of tax loopholes to cut its tax bill by an average of $1 billion per year.

What’s more, Wal-Mart is spending heavily to change the tax code so the company can cut what it pays Uncle Sam by another $720 million per year:

Walmart is working to influence tax legislation in three ways – through lobbying, campaign contributions and issue advocacy via major corporate coalitions. Walmart employs 74 lobbyists – 80 percent of whom have previously served in government – and it has spent $32.6 million lobbying on tax and other issues over the past five years. Tax issues have been by far Walmart’s top lobbying focus.

The study reports that the company is also sheltering $21.4 billion in profits offshore — profits that, as tax journalist David Cay Johnston explained recently, represent a nice little “profit center” for multinationals like Wal-Mart, courtesy of the American government.

But while the company doesn’t like paying taxes, its shareholders, including the Walton family, enjoy having their profits subsidized by others who don’t enjoy armies of accountants working full time to cut their tax bills. According to the Americans for Tax Fairness study, Joe and Jane Taxpayer pick up $6.2 billion per year for Wal-Mart’s underpaid workers in the form of public benefits — food stamps, Medicaid and other assistance for the poor.

As we’ve said before, it’s low-wage employers like Wal-Mart that represent the real “welfare queens” in this country. It’s the Walton heirs — winners of the childbirth lottery — and their fellow investors who live in luxury on the taxpayers’ dime.

This work is licensed under a Creative Commons Attribution-NoDerivatives 4.0 International License.