Thursday marks the 100th anniversary of the federal income tax. That is, the income tax that we have today – the first US tax raised on earned incomes was a temporary one imposed to help pay for the War of 1812. Another helped pay for the Civil War, but was allowed to expire in 1872.

One of the most simplistic statements one can utter is, “taxes are too damn high.” The US has a complex tax system — there are many, many different taxes — so a more salient question than whether taxes are “too high” or “too low” is: who pays what?

The reality is that, overall, the US has one of the lowest tax burdens in the industrial world. If someone’s tax burden is too great to bear, that probably means that someone else isn’t paying a fair share of the cost of maintaining the public services that a modern nation-state requires.

For example, one can certainly say that state and local taxes are too high for poorer residents of Washington State. According to a recent study, those in the bottom 20 percent of the economic pile fork over almost 17 percent of their incomes to Olympia, while the middle 20 percent pay about 10 percent and those at the top – the wealthiest one percent of Washington households – pay less than three percent.

Contrast that with highly profitable corporations that pay nothing at all — their taxes surely can’t be considered “too high.” (Moyers & Company highlighted some of the worst offenders back in May.)

So the real game, if you can play it, is shifting the tax burden onto someone else.

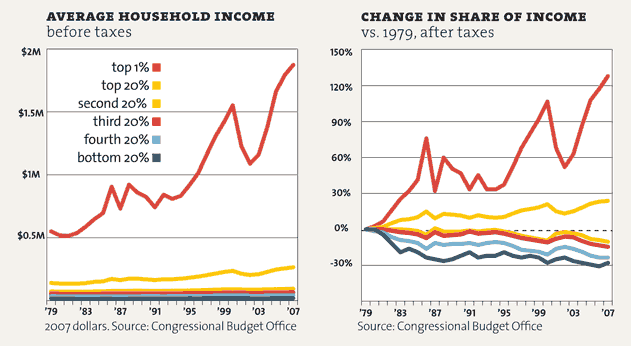

When it comes to individual income taxes, you may have seen some charts like these from Mother Jones, which show that while the incomes of those at the top have spiraled upwards, the share of taxes they pay has dropped precipitously…

But it’s also true that the income tax burden has shifted from corporations to individuals. At the beginning of World War II, individuals and families paid 38 percent of federal income taxes, and corporations picked up the other 62 percent. That’s changed significantly — last year, individuals and families paid 82 percent of federal income taxes, and corporations kicked in just 18 percent.

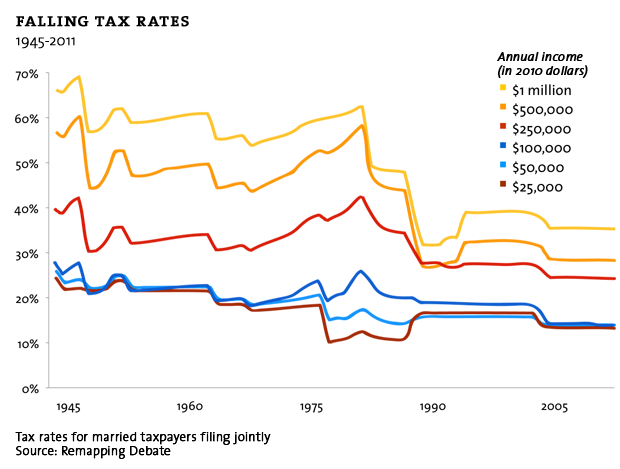

Here’s something interesting about the chart above: since the mid-1960s, the top tax rates for both individuals and corporations have fallen significantly, but individual rates have fallen much further. Of course, the tax rate on the books isn’t important — it’s what one pays that counts (corporate lobbies often complain that the US has the highest corporate tax rates in the world, which is true, but our companies pay a much smaller effective tax rate — and it dropped by 58 percent between 1960 and 2012).

How is it that American corporations are paying a smaller share of federal income taxes when the rates paid by individuals dropped much further? It’s simple: ordinary American families don’t have teams of lobbyists to win them loopholes or armies of tax accountants and attorneys to exploit them.

As Bruce Bartlett wrote this week in The New York Times, this reality has been of concern since the income tax was first established:

Even before the income tax was enacted, the issue of loopholes came up. An article discussing them appeared in The New York Times as early as April 13, 1913. By 1915, one congressman complained: “I write a law. You drill a hole in it. I plug the hole. You drill a hole in my plug.”

Of course, there’s a lot more than federal income taxes to consider when thinking about who pays what. Payroll taxes – which burden working people far more than the wealthy – have increased from around 10 percent of federal revenues in the 1940s to over 30 percent today (XL).