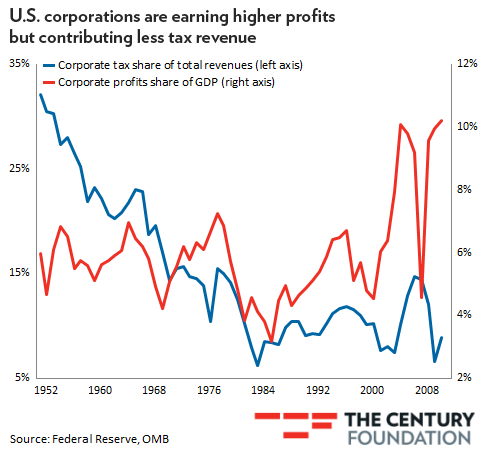

Last week’s quarterly Gross Domestic Product (GDP) report showed corporate profits soaring to record levels, reaching their greatest percentage of GDP in history. But those profits have not translated to increased U.S. government revenue from corporate income taxes, nor have they meant higher wages for Americans, currently at the lowest percentage of GDP since before WWII.

For years, the corporate income tax as a share of total U.S. government revenues paralleled the rise and fall of corporate earnings, and vice versa. But in recent years that correlation has been broken. The Century Foundation’s Benjamin Landy attributes this to corporations becoming more adept at tax avoidance.

But as corporate profits have grown, wages have remained relatively stagnant since the 1990s. The gap between corporate profits and workers’ wages has widened significantly, particularly in the last decade.In 1952, the corporate income tax accounted for about one third of all federal tax revenue. But, over the years, U.S. multinationals have devised increasingly complex tax avoidance schemes, far beyond the ability of the IRS to credibly monitor or enforce. Although the corporate tax rate was also lowered significantly in 1986, tax avoidance is one of the primary reasons why corporate taxes supply less than 9 percent of federal revenues today.

New York Times Columnist Paul Krugman argues that wage stagnation is caused partially by innovation and partially by consolidation. No matter the cause, Krugman writes, “It’s fair to say that the shift of income from labor to capital has not yet made it into our national discourse.”

Yet that shift is happening — and it has major implications. For example, there is a big, lavishly financed push to reduce corporate tax rates; is this really what we want to be doing at a time when profits are surging at workers’ expense? Or what about the push to reduce or eliminate inheritance taxes; if we’re moving back to a world in which financial capital, not skill or education, determines income, do we really want to make it even easier to inherit wealth?

For more on this topic:

- “Corporate Profit Share of GDP Reaches All-Time High Despite Sharia Socialism,” by Matthew Yglesias, Slate

- “These Two Charts Show How The Priorities Of US Companies Have Gotten Screwed Up,” Henry Blodget, Business Insider

- “Gap Between Corporate Profits and Wages Grows to Post-War Record,” Steve Frank, MSNBC.com

- “Corporate Profits Aren’t as High as You Think,” Sam Mamudi, Barrons